A century-old market theory just flashed a rare buy signal, suggesting the three-year-old bull market may still have unfinished business as 2026 gets underway.

In a Monday email note, Adam Turnquist, chief technical strategist at LPL Financial, highlighted that Dow Theory has once again turned bullish.

“A Dow Theory buy signal has been triggered, reinforcing the case that the primary trend for the broader market remains higher,” he said.

The signal rests on a simple but demanding idea.

When industrial stocks and transportation stocks rally together, the broader market trend usually follows.

What Is Dow Theory And Why It Matters

Dow Theory dates back to the early 1900s. It was developed by Charles Dow, co-founder and editor of The Wall Street Journal.

The framework uses two major benchmarks: the Dow Jones Industrial Average and the Dow Jones Transportation Average. The core principle is confirmation.

The logic is intuitive. If industrial firms are producing more goods, transportation companies should see rising demand to ship those goods. When both groups move higher in unison, Dow believed it reflected improving economic conditions and a healthy market trend.

Why Is The Dow-Theory Buy Signal Flashing Now?

According to LPL Financial’s analysis, both pillars of the theory have broken out at the same time.

The Dow Jones Industrial Average has been in a sustained uptrend since clearing new highs in August. While it lagged the broader market in 2025, it still posted a 13% price return.

The Dow Jones Transportation Index lagged earlier in the cycle, but it’s now catching up quickly.

The transportation average has surged 17% over the past six weeks and just reached its first record high since late 2024.

That breakout completed the confirmation Dow Theory requires.

With both indexes making new highs together, the buy signal was triggered.

Transportation Stocks Take The Lead

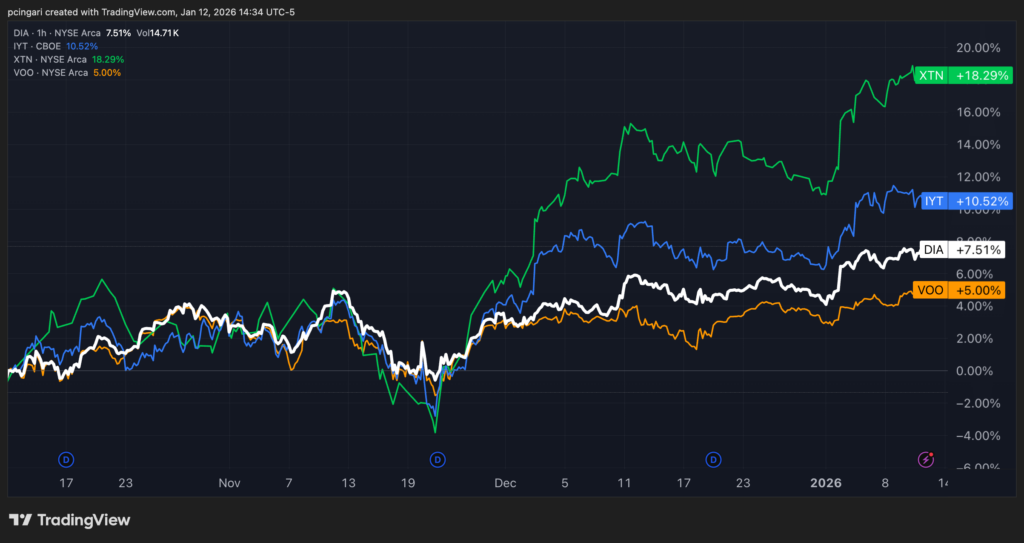

Recent performance shows transportation stocks pulling ahead of the broader market.

Over the past three months, transportation shares have outperformed both industrial stocks and the wider S&P 500.

The SPDR S&P Transportation ETF (NYSE:XTN) has jumped 18.3%. The iShares US Transportation ETF (NYSE:IYT) gained 11%.

Both beat the SPDR Dow Jones Industrial Average ETF (NYSE:DIA), which rose 7.9%, and the Vanguard S&P 500 ETF (NYSE:VOO) over the same period.

Several individual names drove those gains. Sun Country Airlines Holdings Inc. (NASDAQ:SNCY) surged 60.6%. Kirby Corp. (NYSE:KEX) climbed 56.4%. Matson Inc. (NYSE:MATX) rose 50.6%. J.B. Hunt Transport Services Inc. (NASDAQ:JBHT) gained 49.6%. Allegiant Travel Co. (NASDAQ:ALGT) jumped 49.3%.

What History Says About Dow Theory Signals

Historically, Dow Theory buy signals have carried weight.

Since 1964, the S&P 500 has posted average 12-month forward returns of 11.1% following similar signals. The median return stands at 13.9%. Stocks finished higher 83% of the time across the last 12 Dow Theory buy signals.

While no indicator is foolproof, Dow Theory’s long track record helps explain why technicians continue to monitor it closely — especially when it aligns with improving market breadth and sector leadership.

For now, the message from this century-old framework is clear: the bull market’s trend remains intact — and history suggests the next chapter may still be unfolding.

Image created using artificial intelligence via Midjourney.

Recent Comments