Home Depot Inc (NYSE:HD) is trading sharply higher Friday afternoon as investors bet that a new White House housing initiative will unlock fresh demand for home improvement spending. Here’s what investors need to know.

- Home Depot stock is among today’s top performers. Why is HD stock surging?

Lower Mortgage Rates Aim To Break Housing “Lock-In”

President Donald Trump has outlined a plan for the federal government to buy about $200 billion of mortgage-backed securities using cash reserves at Fannie Mae and Freddie Mac, with the goal of driving mortgage rates below 6% and breaking the current “lock-in” effect that has frozen existing-home supply.

Lower borrowing costs would encourage more homeowners to list, more buyers to move, and a surge in move-in and renovation projects that typically funnel spending directly to Home Depot’s aisles.

Individual Buyers Could Boost DIY Demand

Trump also reiterated support for restricting large institutional investors from purchasing single-family homes, a policy shift that could tilt the market back toward individual buyers.

First-time and move-up homeowners historically spend heavily on DIY projects, appliances and yard improvements in the first several years of ownership, a sweet spot for Home Depot’s ticket growth.

Why Home Depot Is Poised To Benefit

Home Depot is the world’s largest home-improvement retailer, operating thousands of big-box stores across North America.

The company sells building materials, tools, plumbing and electrical supplies, décor, appliances and lawn-and-garden products to both professional contractors and do-it-yourself customers, and generates additional revenue from installation and project services.

That broad exposure makes HD a direct beneficiary of any pickup in housing turnover and remodeling activity, helping explain why the stock is outperforming broader equity benchmarks in Friday’s session.

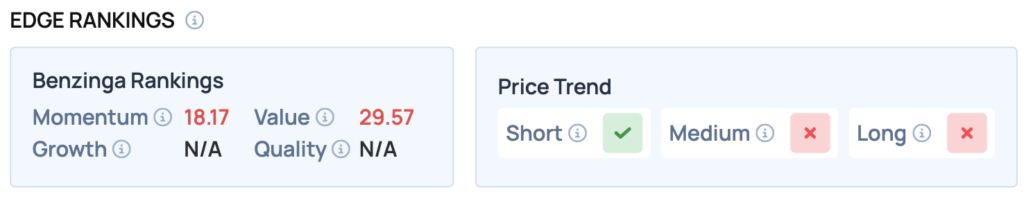

Benzinga Edge Rankings: In Benzinga Edge stock rankings, HD carries a Value score of 29.57 and a short-term bullish price trend, two of the four key scores the service uses to help investors identify the strongest and weakest stocks to buy and sell.

HD Price Action: Home Depot shares were up 3.86% at $373.44 at the time of publication on Friday, according to Benzinga Pro data.

Looking at the 52-week range of $326.31 to $426.75, the stock is currently positioned closer to its yearly high, which could act as a resistance level.

If Home Depot can maintain its current trajectory and break above $374.35, it may pave the way for a test of the upper end of this range. Conversely, if the stock retraces, the $361.31 level could provide a crucial support point for investors looking to enter or add to positions.

Image: Shutterstock

Recent Comments