The United States has declared its intention to maintain a firm grip on Venezuela’s oil industry as the Energy Secretary, Chris Wright, outlined the detailed plan to revive the sector.

Plan Aims To Restart Venezuela Output

Wright, at the Goldman Sachs Energy, CleanTech & Utilities Conference in Miami on Wednesday, stated that the U.S. would continue to oversee the sale of Venezuela’s oil production “indefinitely.” “We will sell the production that comes out of Venezuela into the marketplace,” stated Wright.

The Energy Secretary emphasized that the generated revenue would be reinvested in Venezuela for the benefit of its people. He added that the U.S. would supply diluent to restart production, allow imports of parts and services to stabilize Venezuela’s oil industry, and ultimately create conditions for output growth and renewed investment by major American companies.

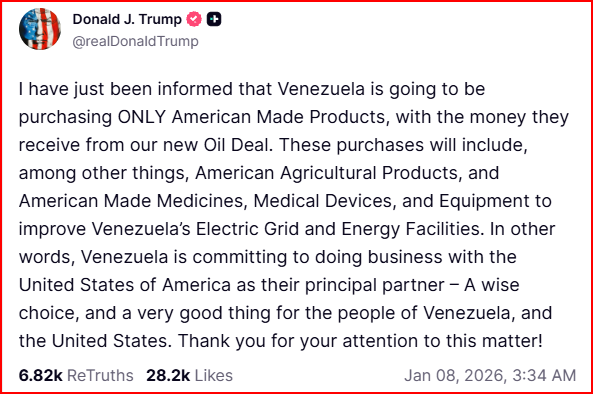

Meanwhile, President Donald Trump announced on Truth Social on Wednesday that Venezuela would exclusively purchase American-made products using the proceeds from the new oil deal. This includes agricultural products, medicines, and equipment to enhance Venezuela’s energy facilities, marking a significant shift in the country’s trade dynamics.

Venezuela Oil Claims Face Skepticism

The U.S.’s assertive stance on Venezuela’s oil industry follows a series of significant developments in the region. On Tuesday, Trump claimed that Venezuela would be turning over 30-50 million barrels of sanctioned crude oil to the U.S., with the proceeds controlled by him.

This move was met with skepticism by some, with economist Paul Krugman arguing that the vast oil wealth Trump envisions in Venezuela doesn’t exist, making this a war for “oil fantasies.” The economist said Venezuela’s oil reserves tripled on paper under Hugo Chávez due to reclassification of heavy crude, not discoveries, and noted that stagnant production despite massive claimed reserves suggests those figures are largely fictional.

Meanwhile, Goldman Sachs stated that the Venezuelan political upheaval has prompted a reset in the global oil market, with the introduction of “two-sided” risks for oil prices in 2026 and reinforcing a more bearish supply story beyond that horizon. This shift in the oil market’s future, as noted by analysts, could have significant implications for Venezuela’s oil industry and its global partners.

When last checked, the Brent Crude oil was trading 0.32% higher at $59.53 per barrel.

Price Action: Over the past week, Energy Select Sector SPDR Fund (NYSE:XLE) edged 0.40% higher, while the iShares U.S. Oil & Gas Exploration & Production ETF (BATS:IEO) fell 1.23%, as per data from Benzinga Pro.

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Recent Comments