AI infrastructure company, Vertiv Holdings Co. (NYSE:VRT), which provides critical data center power and cooling solutions, is expected to be next in line to join the S&P 500 during the first quarter of 2026, according to prediction markets.

Stock ‘Most Likely’ To Be Included In S&P 500

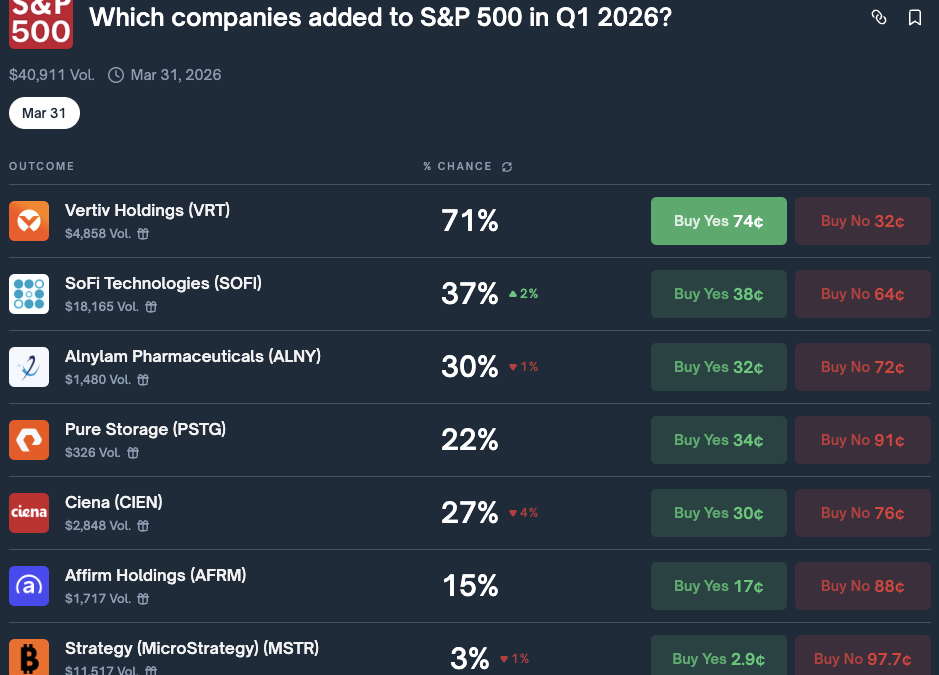

The odds of the Ohio-based AI infrastructure provider joining the elite club of major U.S.-listed companies currently stand at 71% on Polymarket.

Vertiv’s odds are currently higher than those of fintech company SoFi Technologies Inc. (NASDAQ:SOFI), Alnylam Pharmaceuticals Inc. (NASDAQ:ALNY), Pure Storage Inc. (NYSE:PSTG) and Ciena Corp. (NYSE:CIEN), among others, at 37%, 30%, 22% and 27%, respectively.

See Also: Beyond Nvidia: Dan Ives Names Top AI Stocks For 2026

The S&P 500 index, tracked by the SPDR S&P 500 ETF Trust (NYSE:SPY) includes 500 major U.S. companies listed on the NYSE, Nasdaq and the CBOE.

To even be considered for inclusion, a company must carry a minimum market capitalization of $22.7 billion, as of July 1, 2025, along with strong trading activity.

This includes 250,000 shares traded each month for six consecutive months before evaluation, and over the course of a year, investors must trade an amount of the stock equivalent to at least 75% of the company’s market value, ensuring the shares are liquid enough for large institutions to buy and sell without causing major price swings.

Inclusion in the S&P 500 can drive demand for a stock, as all index-tracking funds will be forced to buy shares of any new constituent, often leading to a spike in the stock, referred to as the “inclusion bounce.”

Vertiv’s Monumental Rally

Riding on the coattails of the AI frenzy, Vertiv’s shares have surged over 1,047% in less than three years, with its market capitalization now just under $62 billion.

The company’s financial performance has kept pace with the stock, with revenues surging 29% year-over-year, at $2.68 billion during its recent third-quarter results, with a profit of $1.24 per share, against $0.76 the prior year.

Vertiv also raised its sales outlook for the full-year, to between $10.16 billion and $10.24 billion, up from $9.93 billion and $10.08 billion, backed by a robust backlog at $9.5 billion, up 30% year-over-year.

Analysts at Citigroup recently raised their Price Target on the stock to $220 per share, representing an upside of 35.72% from current levels.

Shares of Vertiv were down 1.38% on Wednesday, closing at $162.01, and are up 3.68% overnight. The stock scores high on Momentum, Growth and Quality in Benzinga’s Edge Stock Rankings, with a favorable price trend in the Medium and Long terms. Click here for deeper insights into the stock, its peers and competitors.

Read More:

Photo courtesy: Shutterstock

Recent Comments