Apple Inc. (NASDAQ:AAPL) has reportedly scaled back production and promotion of its Vision Pro headset after sluggish sales underscored the company’s struggle to turn its much-hyped mixed-reality device into a mass-market success.

Production, Marketing Cutbacks Signal Cooling Demand

Apple’s Chinese manufacturing partner, Luxshare, halted production of the device early last year after shipping roughly 390,000 units during its 2024 launch period, reported the Financial Times, citing International Data Corporation.

Apple has also slashed its digital advertising spend for the Vision Pro by more than 95% year to date in key markets, including the U.S. and the U.K., data from Sensor Tower shows.

See Also: Here’s How Much You Would Have Made Owning Apple Stock In The Last 5 Years

Vision Pro Sales Remain Small By Apple Standards

Apple has not disclosed official sales figures for the Vision Pro, but IDC estimates the company will ship just 45,000 units in the fourth quarter of 2025, traditionally Apple’s strongest sales period due to the holiday season.

That volume pales in comparison to the millions of iPhones, iPads and MacBooks Apple sells every quarter.

Despite launching the device in 13 countries, Apple did not expand the Vision Pro’s international availability in 2025.

Price, Comfort And App Gaps Weigh On Adoption

Analysts point to several factors behind the Vision Pro’s limited traction, including its premium price that starts at $3,499, bulky design and limited battery life.

Morgan Stanley analyst Erik Woodring said the Vision Pro failed to gain broad adoption due to its high cost, bulky design and a limited number of native VisionOS applications.

Apple says about 3,000 apps have been designed specifically for the headset, far fewer than the tens of thousands that arrived within a year of the iPhone App Store’s launch in 2008.

Apple Tweaks Hardware As VR Market Slows

In October, Apple introduced an upgraded Vision Pro powered by its M5 chip, featuring improved performance, longer battery life and a redesigned headband aimed at improving comfort.

The company is also expected to release a lower-priced version of the headset this year.

The challenges extend beyond Apple.

Counterpoint Research estimates the global virtual reality headset market fell 14% year over year, with Meta Platforms, Inc.’s (NASDAQ:META) Quest devices dominating roughly 80% of the category despite facing similar demand headwinds.

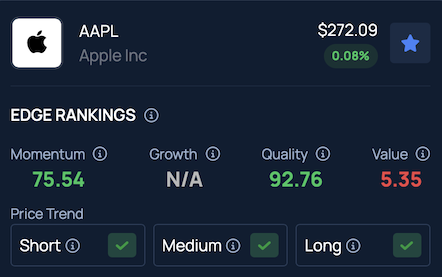

Price Action: Apple shares are up 0.085% in after-hours trading. In the past 12 months, the shares have been up by 11.49%, according to Benzinga Pro.

Benzinga Edge Stock Rankings show that Apple shares are maintaining a strong price trend across short, medium and long-term horizons, with more detailed performance metrics available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: jamesteohart via Shutterstock

Recent Comments