The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

Cal-Maine Foods Inc (NASDAQ:CALM)

- On Dec. 30, Stephens & Co. analyst Pooran Sharma maintained Cal-Maine Foods with an Equal-Weight and lowered the price target from $105 to $95. The company’s stock fell around 3% over the past five days and has a 52-week low of $79.24.

- RSI Value: 29.9

- CALM Price Action: Shares of Cal-Maine fell 1.9% to close at $80.52 on Tuesday.

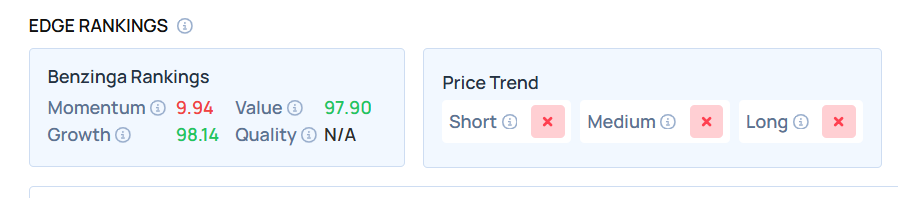

- Edge Stock Ratings: 9.94 Momentum score with Value at 97.90.

Lamb Weston Holdings Inc (NYSE:LW)

- On Dec. 19, the company reported quarterly net sales growth of 1% year-over-year to $1.62 billion, ahead of the $1.59 billion estimate. Overall volume rose 8% led by new customer wins, market share gains, and strong retention, especially in North America and Asia. Mike Smith, Lamb Weston president and CEO, added, “We delivered robust volume growth and gained share in priority markets and key categories, demonstrating Lamb Weston’s commitment to deliver quality, innovation and value. Our team is executing at a high level, and we remain on track to achieve our $100 million cost savings program target for fiscal 2026.” The company’s stock fell around 30% over the past month and has a 52-week low of $41.41.

- RSI Value: 18.5

- LW Price Action: Shares of Lamb Weston rose 0.3% to close at $41.95 on Tuesday.

- Benzinga Pro’s charting tool helped identify the trend in LW stock.

DDC Enterprise Ltd (NYSE:DDC)

- On Nov. 26, DDC Enterprise announced it acquired 100 Bitcoin. The company’s stock fell around 32% over the past month and has a 52-week low of $1.62.

- RSI Value: 28.2

- DDC Price Action: Shares of DDC Enterprise fell 3.3% to close at $2.08 on Tuesday.

- Benzinga Pro’s signals feature notified of a potential breakout in DDC shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Recent Comments