On the final trading day of the year, legendary investor Warren Buffett is set to close one of the most remarkable leadership chapters in corporate history, marking his last day as chief executive of Berkshire Hathaway Inc. (NYSE:BRK) (NYSE:BRK) after more than 55 years at the helm.

Buffett’s Jaw-Dropping Performance

Buffett took control of the struggling textile maker in 1965, when Berkshire’s shares traded around $19, before assuming the role of CEO in 1970. As he prepares to step aside nearly six decades later, the stock now changes hands at $755,400, a staggering 3,975,690% gain over this period.

This represents a compounded annual growth rate of 19.3%, which is more than double the S&P 500’s 7.55% CAGR over the same period.

In other words, $100 invested in Berkshire when Buffett took over more than half a century ago would now be worth $3.96 million compounded annually. The same when invested in the S&P 500, at around the same time, would now be worth just $7,881.

Buffett’s career is a testament to the kind of wealth that can be created with consistent and disciplined investing, compounded over long periods.

What’s Next For Berkshire Hathaway?

At 95, Buffett leaves Berkshire a financial fortress worth $1.08 trillion, with $381.67 billion in cash on its books and $127.24 billion in debt.

It is now a sprawling global conglomerate spanning insurance, railroads, utilities, manufacturing, consumer brands and one of the largest public equity portfolios in the world. The company now owns Geico, BNSF Railway, Berkshire Hathaway Energy, Precision Castparts, Dairy Queen, See’s Candies.

Its public equity portfolio includes significant stakes in companies such as Apple Inc. (NASDAQ:AAPL), American Express Co. (NYSE:AXP), Coca-Cola Co. (NYSE:KO), Bank of America Corp. (NYSE:BAC) and UnitedHealth Group Inc. (NYSE:UNH).

The company’s Vice Chairman, Greg Abel, is set to succeed Buffett as CEO, starting on Jan. 1, 2026, a decision that was announced during its annual shareholder meeting in May 2025.

Having first entered Berkshire’s sphere in 1999, Abel has served as vice chairman for non-insurance operations since 2018, overseeing the company’s various subsidiaries across railroads, utilities, energy, manufacturing, and retail.

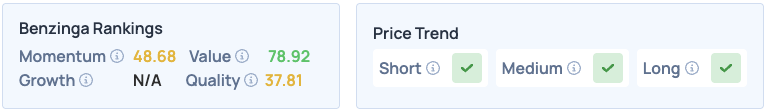

Berkshire Hathaway’s Class B shares were up 0.53% on Tuesday, closing at $503.71, and are down 0.09% overnight. The stock scores high on Value in Benzinga’s Edge Stock Rankings, but does poorly on Momentum and Quality. It has a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock.

Read More:

Photo: Photo Agency On Shutterstock.com

Recent Comments