Economist Peter Schiff is calling out the glaring disconnect between the surging price of silver and the market’s reaction to key silver mining stocks.

These Stocks ‘Should Have Doubled’ In December

On Tuesday, in a series of posts on X, Schiff, a long-time advocate of hard assets and precious metals, pointed out that while silver, tracked by the iShares Silver Trust (NYSE:SLV) surged 35% in December, the Global X Silver Miners ETF (NYSE:SIL), which tracks prominent silver miners, is up just 11%.

“Investors are in denial,” Schiff said, while noting that Silver prices were up by another $4 on Tuesday morning, with miners yet to capture this move.

See Also: Why Investors Need To Pay Attention To Silver Price Action

Schiff said that silver miners typically offer leveraged exposure to the underlying metal, and their lackluster performance in the face of such a sharp rally is puzzling. “Given that move, silver stocks should have doubled” over the course of this month, he said.

Silver prices experienced a steep reversal on Monday, erasing most of Friday’s gains. However, according to Schiff, the real overreaction was in the equities market.

Even though the commodity was still “about 10% above the prior week’s close,” Schiff noted that silver mining stocks gave up all of last week’s gains, even though they “barely rose on Friday” to begin with.

According to Schiff, this mismatch presents an attractive opportunity for investors. “Following a 14% silver correction, silver stocks are even better buys now,” he said.

Mining Stocks, ETFs Fail To Keep Up With Silver’s Rally

Despite a historic surge in silver prices, leading silver mining stocks, junior miners, and ETFs have significantly underperformed, even as the metal notched its strongest monthly rally since the late 1970s, and is up 154.57% year-to-date.

| Stocks / ETFs | Year-To-Date Performance | Month-To-Date Performance |

| Wheaton Precious Metals Corp. (NYSE:WPM) | +104.72% | +8.09% |

| Americas Gold And Silver Corp. (NYSE:USAS) | +444.90% | +13.14% |

| Coeur Mining Inc. (NYSE:CDE) | +191.77% | +6.66% |

| Aya Gold & Silver Inc. (OTC:AYASF) | +89.60% | +7.42% |

| New Pacific Metals Corp. (NYSE:NEWP) | +181.75% | +24.56% |

| Pan American Silver Corp. (NYSE:PAAS) | +146.56% | +14.34% |

| First Majestic Silver Corp. (NYSE:AG) | +170.08% | +6.76% |

| iShares MSCI Global Silver and Metals Miners ETF (BATS:SLVP) | +186.05% | +8.80% |

| Amplify Junior Silver Miners ETF (NYSE:SILJ) | +167.40% | +7.86% |

| Global X Silver Miners ETF | +158.18% | +9.53% |

Silver prices soared by over 6% to $76 per ounce on Tuesday, and are currently down 1.44% on Wednesday early morning, at $75.13 per ounce.

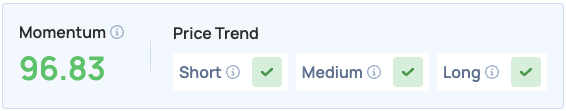

The Global X Silver Miners ETF was up 1.38% on Tuesday, closing at $85.51, and is up 0.57% overnight. The fund scores high on Momentum in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the fund, its peers and competitors.

Photo Courtesy: Tamer A Soliman on Shutterstock.com

Read More:

Recent Comments