AST SpaceMobile Inc (NASDAQ:ASTS) shares are trading higher Tuesday afternoon, extending a year-to-date rally of nearly 250%. The move comes as investors digest the company’s latest satellite milestone and look ahead to a busy launch schedule in 2026.

- AST SpaceMobile shares are climbing with conviction. Why are ASTS shares rallying?

Here’s what investors need to know.

What To Know: AST SpaceMobile recently confirmed the successful orbital launch of its BlueBird 6 spacecraft, now the largest commercial communications array in low Earth orbit.

The satellite spans roughly 2,400 square feet, about three times larger than the company’s earlier BlueBird craft, and is designed to deliver peak data rates of up to 120 Mbps directly to standard smartphones.

Management says BlueBird 6 marks the transition to scaled deployment, with plans to launch 45 to 60 satellites by the end of 2026. The company operates nearly 500,000 square feet of manufacturing and operations space and has agreements with more than 50 mobile network operators worldwide.

Space stocks broadly have also caught a bid in recent sessions amid reports that Elon Musk’s SpaceX is weighing a potential 2026 initial public offering.

EXCLUSIVE: SpaceX IPO Could ‘Open The Floodgates’ – How Private Companies, Tesla Will Be Impacted

What Else: In November, AST SpaceMobile reported a third-quarter loss of 45 cents per share on revenue of $14.7 million, missing Wall Street estimates on both metrics.

Adjusted operating expenses rose to $67.7 million, driven by higher engineering, gateway and administrative costs, though the company reaffirmed second-half 2025 revenue guidance of $50 million to $75 million.

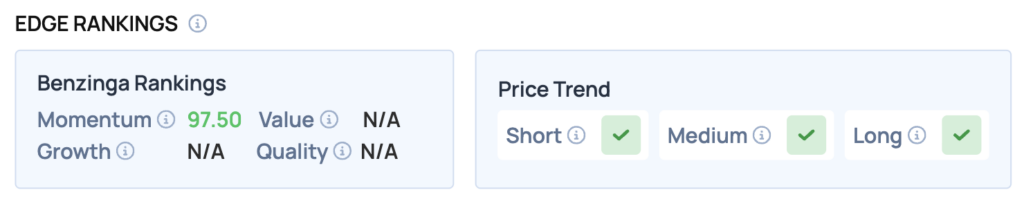

Benzinga Edge Rankings: According to Benzinga Edge rankings, AST SpaceMobile carries a Momentum score of 97.50, signaling exceptionally strong price momentum across short-, medium- and long-term trends.

ASTS Price Action: AST SpaceMobile shares closed up 4.49% at $74.68 on Tuesday, according to Benzinga Pro data.

Support levels can be identified around the recent low of $72.04, which could act as a floor for the stock should it experience any pullbacks. Conversely, resistance is likely to be encountered near the recent high of $78.34, where profit-taking may occur.

The overall technical outlook for ASTS appears positive, with the stock trading well above key price levels. If momentum continues, there may be further opportunities for gains, especially if the stock can break through resistance levels and maintain its upward trajectory.

Read Also:

• What’s Going On With Intuitive Machines Stock Tuesday?

Image: Shutterstock

Recent Comments