Baidu Inc (NASDAQ:BIDU) shares are trading higher Tuesday morning, extending a recent rebound even as the session lacks fresh, company-specific headlines. The move comes against the backdrop of growing optimism around the Chinese tech giant’s autonomous-driving ambitions.

- Baidu shares are powering higher. Why is BIDU stock up today?

What To Know: Baidu’s Apollo Go robotaxi unit has emerged as a key long-term growth story for the company. The service recently reported it is now handling about 250,000 rides per week and has logged more than 140 million driverless miles with roughly 17 million robotaxi ride orders, highlighting rapid scaling in cities including Wuhan, Beijing, Shenzhen and Shanghai.

The platform has also emphasized its safety record, citing only one incident involving an airbag deployment for every 6.2 million miles driven, with no injuries reported.

International expansion hopes are another element supporting sentiment. Ride-hailing giants Uber and Lyft have announced plans to partner with Apollo Go to pilot self-driving taxis in London, with testing expected to begin in the first half of 2026, subject to regulatory approval. The deal positions Baidu as a prominent competitor in the global robotaxi race alongside Alphabet’s Waymo, Tesla and Pony.ai.

With no new filings or news out Tuesday, the latest upside in BIDU may reflect investors continuing to price in the potential of Baidu’s autonomous-driving ecosystem rather than reacting to a specific catalyst, keeping the stock in focus as a play on the future of mobility.

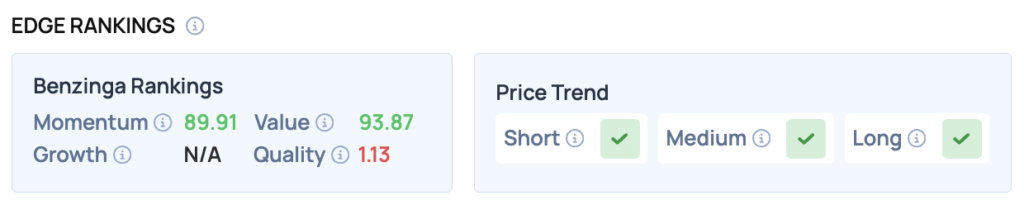

Benzinga Edge Rankings: According to Benzinga Edge rankings, Baidu stands out on valuation with a Value score of 93.87, signaling strong relative attractiveness compared with peers.

BIDU Price Action: Baidu shares were up 5.45% at $133.72 at the time of publication on Tuesday, according to Benzinga Pro data.

On the downside, key support levels can be identified around the $121.94 mark, which aligns with the recent average price. A decline below this level could trigger further selling pressure, as it would indicate a break from the current bullish trend.

In the broader market context, Baidu’s performance may be influenced by ongoing developments in the tech sector and regulatory environment in China. Investors should remain vigilant about macroeconomic factors that could impact sentiment, particularly as the company navigates competitive pressures and regulatory scrutiny.

Image: Shutterstock

Recent Comments