U.S. stock futures swung between gains and losses on Tuesday after Monday’s declines. Futures of major benchmark indices were mixed.

The Santa Claus rally, which began on Dec. 24 last week, seems to have resumed gains after a day of losses on Monday.

Meanwhile, President Donald Trump escalated his long-standing conflict with Federal Reserve Chair Jerome Powell on Monday by threatening a lawsuit over alleged “gross incompetence,” a move that has reignited concerns regarding central bank independence just months before Powell’s term concludes in 2026.

Investors face a quiet week for economic data, with markets scheduled to be closed on Thursday in observance of New Year’s Day.

The 10-year Treasury bond yielded 4.12%, and the two-year bond was at 3.45%. The CME Group’s FedWatch tool‘s projections show markets pricing an 83.9% likelihood of the Federal Reserve leaving the current interest rates unchanged in January.

| Futures | Change (+/-) |

| Dow Jones | 0.01% |

| S&P 500 | -0.01% |

| Nasdaq 100 | -0.01% |

| Russell 2000 | 0.11% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Tuesday. The SPY was down 0.0073% at $687.80, while the QQQ declined 0.0081% to $620.82, according to Benzinga Pro data.

Stocks In Focus

TEN Holdings

- TEN Holdings Inc. (NASDAQ:XHLD) shares jumped 16.31% in premarket on Tuesday after announcing a $2.25 million private placement of 991,000 shares at $2.27 per share.

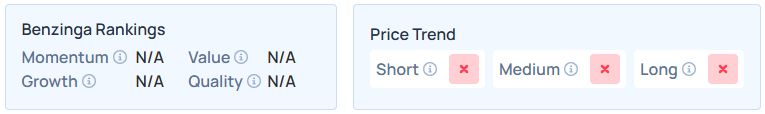

- It maintains a weaker price trend over the short, medium, and long terms. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Fonar

- Fonar Corp. (NASDAQ:FONR) surged 24.49% after the company announced it signed a definitive agreement for a “take private” sale.

- FONR maintains a stronger price trend over the short, medium, and long terms, with a moderate quality. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Boeing

- Boeing Co. (NYSE:BA) was up 0.58% after the Pentagon awarded it an $8.6 billion contract for the F-15 Israel Program.

- Benzinga’s Edge Stock Rankings indicate that BA maintains a stronger price trend over the short, medium, and long terms. Additional performance details are available here.

Dermata Therapeutics

- Dermata Therapeutics Inc. (NASDAQ:DRMA) was 6.45% higher following an announcement that it closed a $12.4 million private placement priced at-the-market under Nasdaq rules.

- DRMA maintains a weaker price trend over the short, medium, and long terms. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

Freeport-McMoRan

- Freeport-McMoRan Inc. (NYSE:FCX) rose 1.36% as the copper prices rose past a new record high of $12,000 during the week.

- Benzinga’s Edge Stock Rankings shows that FCX maintains a stronger price trend over the short, medium, and long term, with a moderate value ranking. Additional information is available here.

Cues From Last Session

Consumer discretionary, materials, and financials recorded the biggest losses on Monday, though energy and real estate stocks bucked the trend to close higher.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -0.50% | 23,474.35 |

| S&P 500 | -0.35% | 6,905.74 |

| Dow Jones | -0.51% | 48,461.93 |

| Russell 2000 | -0.57% | 2,519.80 |

Insights From Analysts

Comerica Wealth Management approaches 2026 with “cautious optimism,” forecasting a U.S. economy supported by a “trifecta of growth drivers”: infrastructure spending, AI adoption, and resilient consumer demand.

While recession risks remain under 30%, inflation is expected to stay sticky above the Federal Reserve’s 2% target.

Regarding equities, Comerica notes the market is entering a fourth consecutive year of a bull run with valuations that “appear stretched.”

Chief Investment Officer Eric Teal advises investors to “resist the temptation to follow the investing Toms and Daisys”—a reference to the careless excess of the 1920s.

Instead, the firm recommends a defensive stance, urging clients to “stay prudent, avoid being overly aggressive and apply a bit of caution”.

Investors are encouraged to look beyond tech giants, as small and micro-cap companies are poised to outperform amid falling rates. Opportunities also exist in “traditional value sectors like financials” that align with a steeper yield curve.

See Also: How to Trade Futures

Upcoming Economic Data

Here’s what investors will be keeping an eye on Tuesday.

- October’s S&P Case-Shiller home price index for 20 cities will be released at 9:00 a.m., December’s Chicago Business Barometer (PMI) will be out by 9:45 a.m., and minutes of the Fed’s December FOMC meeting will be released by 2:00 p.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 0.50% to hover around $58.37 per barrel.

Gold Spot US Dollar rose 0.88% to hover around $4,369.96 per ounce. Its last record high stood at $4,550.11 per ounce. The U.S. Dollar Index spot was 0.07% lower at the 97.9710 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.53% lower at $87,671.07 per coin.

Asian markets closed lower on Tuesday, except China’s CSI 300 and Hong Kong’s Hang Seng indices. South Korea’s Kospi, Australia’s ASX 200, India’s Nifty 50, and Japan’s Nikkei 225 indices fell. European markets were higher in early trade.

Read Next:

Photo courtesy: Frontpage / Shutterstock.com

Recent Comments