Boeing Co. (NYSE:BA) has been awarded an $8.6 billion contract for the F-15 Israel Program, the Pentagon announced on Monday, after President Donald Trump met Israeli Prime Minister Benjamin Netanyahu in Florida.

Jets To Be Made Over 10 Years

The U.S. has long been by far the largest arms supplier to its closest Middle East ally. This deal includes the design, integration, and delivery of 25 new F-15IA aircraft for the Israeli Air Force, with an option for an additional 25 planes.

The work associated with this contract will be conducted in St. Louis and is expected to be completed by Dec. 31, 2035, the Pentagon said.

The F-15IA is Israel’s version of the advanced F-15EX, the newest evolution of the decades-old F-15. The backbone of Israel’s air force, it has been used extensively over the past two years in operations targeting Iran, the Houthis in Yemen, and Hezbollah in Lebanon.

Last November, Israel signed a $5.2 billion deal for 25 F-15IAs, which were slated to be supplied in batches of four to six per year, starting in 2031. Monday’s deal brings the total number of F-15IAs to 50, adding to the 66 other F-15 variants in the Israeli Air Force’s arsenal.

Trump ‘Seriously’ Considers Turkey Fighter Jet Sale

Meanwhile, Trump on Monday said that his administration is seriously considering selling advanced F-35 fighter jets to Turkey, speaking during a press conference alongside Netanyahu.

Asked about a potential deal as he hosted the Israeli prime minister at his Mar-a-Lago resort, Trump said, “We’re thinking about it very seriously.”

Trump maintains close ties with Turkish President Recep Tayyip Erdogan, despite the longtime leader’s sharp criticism of Israel over its actions in Gaza.

Israel has previously voiced concern about the possible sale of F-35s to Turkey and other regional countries. Those concerns have grown after Trump recently announced plans to sell the stealth fighters to Saudi Arabia.

What’s Going On With Boeing Stock?

Boeing shares slightly ticked up on Monday after hours and were last trading at $217.62. Over the past 12 months, the stock has seen a strong performance, gaining 23.05%.

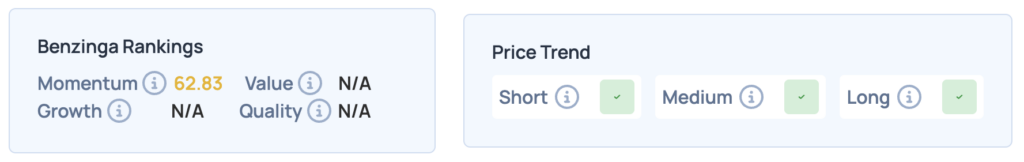

Benzinga’s proprietary Edge Rankings show Momentum as the strongest category for BA, while the price trend is positive across time periods.

READ NEXT:

Image via Shutterstock

Recent Comments