Shares of Bloom Energy Corp (NYSE:BE) are trading lower Friday morning, as the stock pulls back from recent volatility amid news of a new credit agreement earlier in the week. Here’s what investors need to know.

- Bloom Energy stock is under selling pressure. Why is BE stock trading lower?

What To Know: On Tuesday, the clean energy provider announced it had entered into a new credit agreement with Wells Fargo Bank, National Association, establishing a $600 million senior secured multicurrency revolving credit facility.

The new facility, which matures in December 2030, replaces prior arrangements and, per the company, offers Bloom flexible borrowing capacity in U.S. dollars, euros, British pounds, Japanese yen and Singapore dollars.

Management indicated that proceeds from the facility will be used to finance working capital, capital expenditures and potential acquisitions.

While the financing bolsters Bloom’s balance sheet as it scales operations, the stock has dropped 12% over the past month, retreating significantly from its 52-week high of $147.86 reached earlier in 2025.

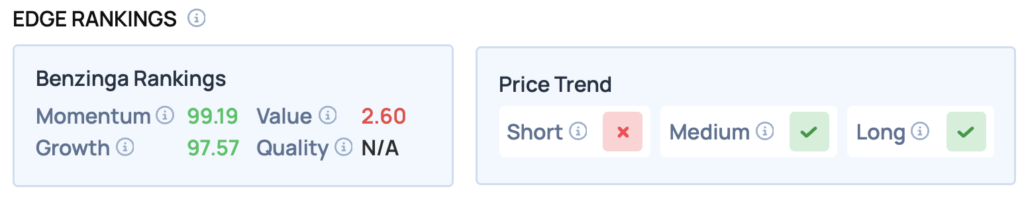

Benzinga Edge Rankings: Benzinga Edge rankings highlight the stock’s exceptional market strength with a near-perfect Momentum score of 99.19, despite its low Value rating of 2.60.

BE Price Action: Bloom Energy shares were down 2.02% at $90.12 at the time of publication on Friday, according to Benzinga Pro data.

Support levels appear to be forming around the $88 mark, which, if breached, could open the door to a test of lower levels. Conversely, if the stock can hold above this support, it may provide a base for a rebound, particularly if broader market conditions improve.

Read Also: China’s New EV Energy Limits Contrast With US Rollback Of Fuel Economy Standards

How To Buy BE Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Bloom Energy’s case, it is in the Industrials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock

Recent Comments