On Thursday, China called for cooperation and fair treatment, as ByteDance moved to transfer control of TikTok’s U.S. operations to an Oracle Corp (NYSE:ORCL)-led investor group in an effort to avert a potential ban.

China Calls For Cooperation On TikTok Deal

China said it hopes companies involved in the TikTok transaction will reach solutions that comply with Chinese laws and regulations while balancing the interests of all parties, reported Reuters.

Speaking at a press briefing, Commerce Ministry spokesperson He Yongqian said Beijing expects the U.S. to cooperate with China and honor its commitments tied to the deal.

He said they hope the U.S. will “work with China in the same direction” and provide what he described as a “fair, open, transparent and non-discriminatory” business environment that allows Chinese companies to operate in the U.S. on a stable and continuous basis.

See Also: Larry Ellison’s 2025: How Oracle, Tesla And Paramount Skydance Merger Propelled Him Past Elon Musk

ByteDance Moves To Avoid US Ban

ByteDance, TikTok’s China-based owner, last week signed binding agreements to hand control of the app’s U.S. business to a group of investors that includes Oracle.

The move was aimed at ending years of regulatory uncertainty and avoiding a U.S. ban over national security concerns.

U.S. officials have long argued that TikTok’s ownership structure could expose American user data to the Chinese government, a claim ByteDance has repeatedly denied.

ByteDance Plans $23 Billion AI Infrastructure Push In 2026

ByteDance is also reportedly preparing to ramp up spending on artificial intelligence infrastructure in 2026, setting aside about CNY 160 billion ($23 billion), up from roughly CNY 150 billion invested this year.

While ByteDance ranks among China’s leading builders of AI infrastructure and has ambitions to become a global player, its spending still trails that of U.S. tech heavyweights.

Companies including Microsoft Corp (NASDAQ:MSFT), Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), Amazon.com, Inc. (NASDAQ:AMZN) and Meta Platforms, Inc. (NASDAQ:META) have collectively invested close to $400 billion this year to expand data centers that support AI models and services.

Meanwhile, earlier this week, the Donald Trump administration signaled a hard-line approach toward Chinese semiconductors while postponing the imposition of tariffs until 2027.

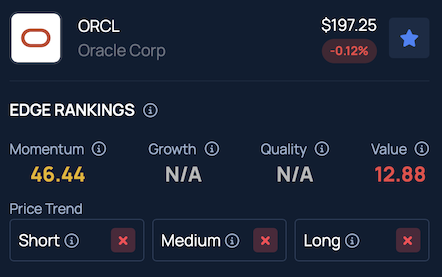

According to Benzinga Edge Stock Rankings, Oracle is showing a negative price trend in the short, medium and long term. Click here for deeper insights into the stock, its peers and competitors.

Read Next:

Photo Courtesy: Ascannio on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Recent Comments