Amidst the fast-paced and highly competitive business environment of today, conducting comprehensive company analysis is essential for investors and industry enthusiasts. In this article, we will delve into an extensive industry comparison, evaluating Micron Technology (NASDAQ:MU) in comparison to its major competitors within the Semiconductors & Semiconductor Equipment industry. By analyzing critical financial metrics, market position, and growth potential, our objective is to provide valuable insights for investors and offer a deeper understanding of company’s performance in the industry.

Micron Technology Background

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Micron Technology Inc | 26.26 | 5.29 | 7.37 | 9.28% | $8.35 | $7.65 | 56.65% |

| NVIDIA Corp | 46.83 | 38.68 | 24.85 | 29.14% | $38.75 | $41.85 | 62.49% |

| Broadcom Inc | 73.23 | 20.37 | 26.54 | 11.02% | $9.86 | $12.25 | 28.18% |

| Taiwan Semiconductor Manufacturing Co Ltd | 30.92 | 9.73 | 13.38 | 9.44% | $691.11 | $588.54 | 30.31% |

| Advanced Micro Devices Inc | 112.51 | 5.76 | 10.95 | 2.06% | $2.11 | $4.78 | 35.59% |

| Qualcomm Inc | 34.88 | 8.83 | 4.36 | -12.88% | $3.51 | $6.24 | 10.03% |

| Intel Corp | 605.83 | 1.63 | 3 | 3.98% | $7.85 | $5.22 | 2.78% |

| Texas Instruments Inc | 32.26 | 9.68 | 9.39 | 8.21% | $2.24 | $2.72 | 14.24% |

| Analog Devices Inc | 60.69 | 4.01 | 12.47 | 2.32% | $1.47 | $1.94 | 25.91% |

| ARM Holdings PLC | 143.62 | 16.05 | 27.07 | 3.3% | $0.22 | $1.11 | 34.48% |

| Marvell Technology Inc | 30.87 | 5.29 | 9.77 | 13.84% | $2.58 | $1.07 | 36.83% |

| NXP Semiconductors NV | 27.93 | 5.66 | 4.78 | 6.43% | $1.11 | $1.79 | -2.37% |

| Monolithic Power Systems Inc | 24.21 | 12.67 | 17.07 | 5.12% | $0.21 | $0.41 | 18.88% |

| ASE Technology Holding Co Ltd | 31.62 | 3.37 | 1.72 | 3.56% | $32.4 | $28.88 | 5.29% |

| First Solar Inc | 20.67 | 3.21 | 5.73 | 5.19% | $0.61 | $0.61 | 79.67% |

| Credo Technology Group Holding Ltd | 127.42 | 20.76 | 35.46 | 7.99% | $0.09 | $0.18 | 272.08% |

| ON Semiconductor Corp | 76.29 | 2.83 | 3.76 | 3.22% | $0.44 | $0.59 | -11.98% |

| STMicroelectronics NV | 44.93 | 1.30 | 2.06 | 1.33% | $0.31 | $1.06 | -1.97% |

| United Microelectronics Corp | 14.88 | 1.75 | 2.63 | 4.29% | $30.07 | $17.62 | -2.25% |

| Tower Semiconductor Ltd | 69.99 | 4.77 | 9.07 | 1.9% | $0.13 | $0.09 | 6.79% |

| Lattice Semiconductor Corp | 382.65 | 14.82 | 21.37 | 0.4% | $0.01 | $0.09 | 4.92% |

| Rambus Inc | 44.85 | 7.87 | 15.10 | 3.84% | $0.08 | $0.14 | 22.68% |

| Average | 97.0 | 9.48 | 12.41 | 5.41% | $39.29 | $34.15 | 32.03% |

Upon analyzing Micron Technology, the following trends can be observed:

-

At 26.26, the stock’s Price to Earnings ratio is 0.27x less than the industry average, suggesting favorable growth potential.

-

Considering a Price to Book ratio of 5.29, which is well below the industry average by 0.56x, the stock may be undervalued based on its book value compared to its peers.

-

The Price to Sales ratio is 7.37, which is 0.59x the industry average. This suggests a possible undervaluation based on sales performance.

-

The Return on Equity (ROE) of 9.28% is 3.87% above the industry average, highlighting efficient use of equity to generate profits.

-

The company has lower Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $8.35 Billion, which is 0.21x below the industry average. This potentially indicates lower profitability or financial challenges.

-

The company has lower gross profit of $7.65 Billion, which indicates 0.22x below the industry average. This potentially indicates lower revenue after accounting for production costs.

-

The company’s revenue growth of 56.65% exceeds the industry average of 32.03%, indicating strong sales performance and market outperformance.

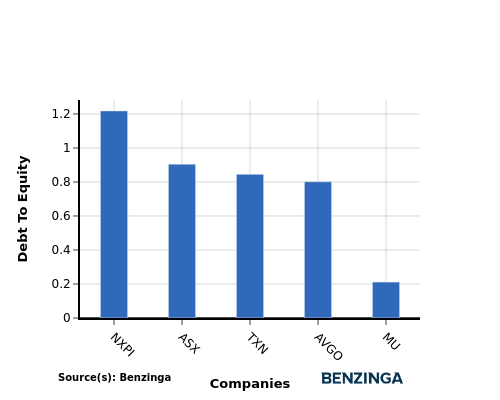

Debt To Equity Ratio

The debt-to-equity (D/E) ratio is a measure that indicates the level of debt a company has taken on relative to the value of its assets net of liabilities.

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company’s financial health and risk profile, aiding in informed decision-making.

When examining Micron Technology in comparison to its top 4 peers with respect to the Debt-to-Equity ratio, the following information becomes apparent:

-

Among its top 4 peers, Micron Technology has a stronger financial position with a lower debt-to-equity ratio of 0.21.

-

This indicates that the company relies less on debt financing and maintains a more favorable balance between debt and equity, which can be viewed positively by investors.

Key Takeaways

For Micron Technology in the Semiconductors & Semiconductor Equipment industry, the PE, PB, and PS ratios are all low compared to peers, indicating potential undervaluation. On the other hand, the high ROE and revenue growth suggest strong performance relative to industry standards. However, the low EBITDA and gross profit may raise concerns about operational efficiency and profitability.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Recent Comments