Oracle Corp (NYSE:ORCL) shares are trading lower Tuesday afternoon, reversing gains from Monday’s surge as new details emerge regarding the structure of its potential TikTok partnership.

- Oracle shares are experiencing downward pressure. What’s driving ORCL stock lower?

What To Know: While the stock rallied Monday on reports that a consortium led by Oracle, Silver Lake and MGX agreed to acquire a significant stake in TikTok’s U.S. operations, sentiment appears to have cooled following a leaked memo. The memo reveals that the new U.S. investors may wield significantly less influence than anticipated.

According to TikTok CEO Shou Chew, the new investors will not control key profit centers such as TikTok Shop or ad sales. Instead, their control will likely be limited to a new independent unit focused on data security and content moderation.

This development adds to existing volatility for Oracle. The company recently reported mixed second-quarter results, narrowly missing revenue estimates despite cloud growth. Additionally, investor confidence was shaken earlier this month when financing partner Blue Owl Capital withdrew from a planned $10 billion data center project.

Meanwhile, competition in the AI sector remains fierce. Reports indicate TikTok parent ByteDance plans to invest $23 billion in AI infrastructure in 2026 to compete with U.S. tech giants, further highlighting the capital-intensive nature of the landscape Oracle is navigating.

Read Also: Larry Ellison’s 2025: How Oracle, Tesla, And Paramount Skydance Merger Propelled Him Past Elon Musk

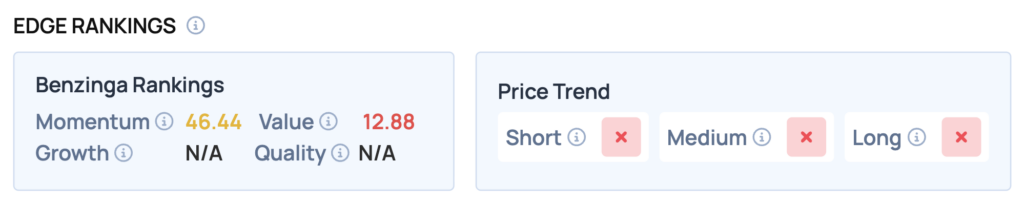

Benzinga Edge Rankings: Benzinga Edge data highlights the current caution, assigning Oracle a Value score of 12.88 while indicating negative trends across short, medium and long-term price horizons.

ORCL Price Action: Oracle shares were down 1.89% at $194.63 at the time of publication on Tuesday, according to Benzinga Pro data.

The current price is significantly below key technical levels, suggesting a bearish sentiment among investors. With the stock trading 16.9% below its recent high and 8.7% below another critical benchmark, this downward trend may raise concerns about the stock’s near-term performance.

Read Also: What’s Going On With ZIM Stock Tuesday?

Image: Shutterstock

Recent Comments