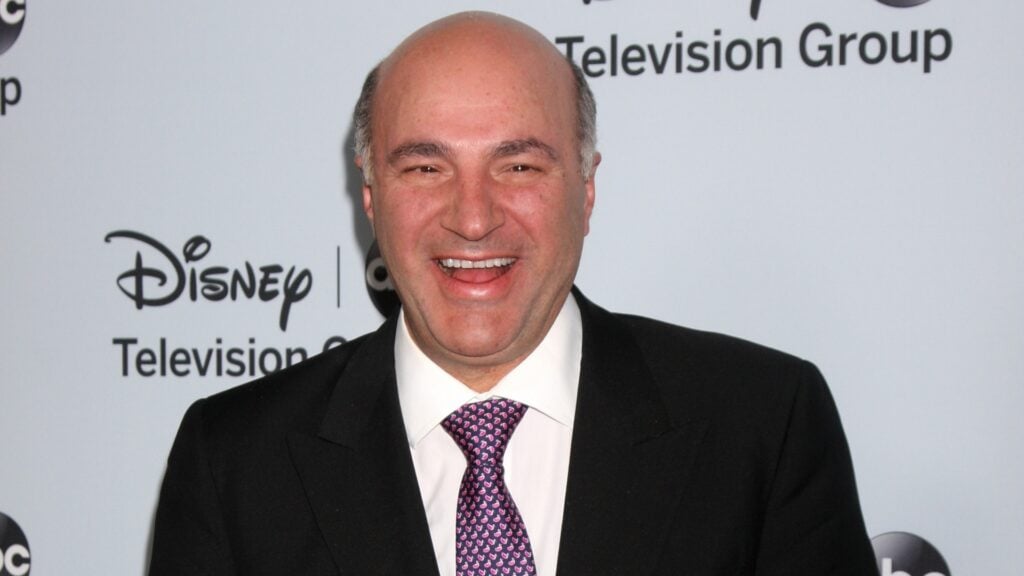

“Shark Tank” investor Kevin O’Leary has issued a stark warning regarding the proposed $2,000 “tariff dividend” cheques linked to the new ‘Trump Accounts’ initiative, labeling the concept “helicopter money” that risks reigniting the country’s battle with soaring inflation.

Inflation Trap

In a video shared by him on X, he reacted to the proposed payouts, arguing that the U.S. economy cannot afford another injection of unearned cash. Drawing a direct parallel to pandemic-era stimulus, he stated, “We tried that during COVID and it drove inflation straight up to 9%.”

According to O’Leary, the average American family is still suffering the consequences of that policy through persistently high prices for “groceries, protein, and everyday essentials.”

He insisted that the priority must be cooling inflation down toward the Federal Reserve’s 2% mandate, rather than introducing new liquidity that could reverse recent progress.

See Also: The $6 Spark That Inspired Michael Dell’s $6.25 Billion Donation To Trump Accounts

Tariff Logic Questioned

O’Leary also dismantled the funding mechanism for these dividends, specifically criticizing tariffs on goods the U.S. does not produce domestically.

“We’re slapping tariffs on things like bananas and pineapples… That makes zero sense,” O’Leary said. “If we don’t produce it, why are we taxing it and making life more expensive for families?”

He predicts that affordability and healthcare will become “weaponized” issues that dominate the upcoming midterm elections in January.

A Contentious Rollout

O’Leary’s economic critique adds to a growing storm surrounding the “Invest America Act” and its associated Trump Accounts. While tech mogul Michael Dell has pledged over $6.25 billion to seed the accounts, other voices have been far more skeptical.

Tesla Inc. (NASDAQ:TSLA) CEO Elon Musk dismissed the debate entirely, claiming that AI and robotics will eventually “eliminate scarcity,” rendering money obsolete—a stance famously mocked by short-seller Jim Chanos, who noted that if money has no value, neither does the stock market, fueling Musk’s wealth.

Meanwhile, tax experts are sounding the alarm on a practical level. Due to a legislative oversight regarding “future interest” gifts, parents who contribute their own funds to these accounts may trigger complex IRS Form 709 filings, creating a potential “compliance nightmare” for average families.

S&P 500, Nasdaq, Dow Jones Gain Year-To-Date

After a series of federal and economic headwinds, the stock market remained resilient in 2025, with all three major U.S. benchmark indices advancing over the course of the year.

The S&P 500 was 17.21% higher, whereas the Nasdaq Composite and Dow Jones gained 21.51% and 14.08%, respectively, on a year-to-date basis.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, closed higher on Monday. The SPY was up 0.62% at $684.83, while the QQQ advanced 0.47% to $619.16, according to Benzinga Pro data.

The futures of Dow Jones, S&P 500, and Nasdaq 100 indices were mixed on Tuesday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Kathy Hutchins / Shutterstock.com

Recent Comments