iBuying platform Opendoor Technologies Inc. (NASDAQ:OPEN) has rolled out its Cash Plus service to nearly every ZIP code in the U.S. in just a matter of weeks, underscoring the scale and speed unlocked by its recent adoption of artificial intelligence.

Opendoor’s AI-Driven Nationwide Expansion

On Monday, Opendoor’s new CEO, Kaz Nejatian, drew a sharp contrast between the company’s early growth years and its latest push.

Its initial expansion, limited to just a small cluster of ZIP codes, unfolded over a period of 10 years, while its recent nationwide rollout was completed in about 10 weeks, a shift he attributed to the company’s growing use of artificial intelligence.

See Also: AI Bubble Fears Grow, But Investors Say Valuations Are Powering Next Wave Of Innovation

In fact, as recently as last week, Opendoor was active in only a limited set of key markets, whereas today its services span nearly the entire country, with just a few gaps remaining in between.

Opendoor, which aims to simplify home buying and selling, said in a post on X, that homeowners located all across the country can now get cash upfront as they look for their next home, while the platform sells their current home “for market value.”

Every Major Business Is ‘Excited About AI’

Investor and entrepreneur Anthony Pompliano, who is also a shareholder in Opendoor, praised the company’s growth, while also highlighting the broader implications of AI on business.

“This is why every major business is excited about AI and the productivity gains,” he said, in a post on X, with an accompanying video snippet where he pushed back against talks of an AI bubble, saying that companies were only just starting to hit “escape velocity” using AI, and that there was still a long way to go.

“Every business I know that’s worth anything” is already deploying the technology internally, allowing teams to move faster and accomplish more with leaner headcounts, he said, adding that the end result is companies becoming “more productive, more efficient,” and increasingly able to “drive more revenue and profit” with fewer people than before.

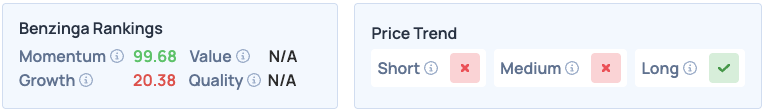

Opendoor shares were up 0.94% on Monday, closing at $6.42, and are up 0.47% overnight. The stock scores high on Momentum in Benzinga’s Edge Stock Rankings, with a favorable price trend in the long run. Click here for deeper insights into the stock, its peers and competitors.

PJ McDonnell from Shutterstock

Read More:

Recent Comments