Vale SA (NYSE:VALE) shares are rallying Monday afternoon amid a broader surge in precious metals stocks driven by fiscal deficits in major economies including the U.S., U.K. and China. Here’s what investors need to know.

- Vale shares are powering higher. Why is VALE stock up today?

What To Know: While soaring gold prices have lifted the commodities sector, Vale’s specific move higher is likely fueled by investor confidence in its response to a softening iron ore market and an aggressive pivot toward copper.

Despite a recent BMI study forecasting long-term iron ore headwinds, predicting prices to fall to $78 per ton by 2034 due to China’s slowing steel cycle, Vale is rising as the company is successfully insulating itself from these risks.

The market is also likely rewarding Vale’s recent capital allocation. The miner reduced its 2026 iron ore production forecast to 335–345 million tons and tightened its capex guidance to $5.5 billion. By avoiding aggressive expansion in a saturated market, Vale has been prioritizing free cash flow over volume.

Furthermore, investors are potentially pricing in growth from Vale’s ambitious copper strategy, viewed as a promising hedge against iron ore volatility. The company confirmed plans to produce 700,000 tons of copper annually by 2035, bolstered by a new $2 billion joint venture with Glencore in Ontario’s Sudbury Basin.

This strategic reallocation from stagnant steel inputs to electrification metals positions Vale to capitalize on the very macroeconomic trends currently driving the sector’s momentum.

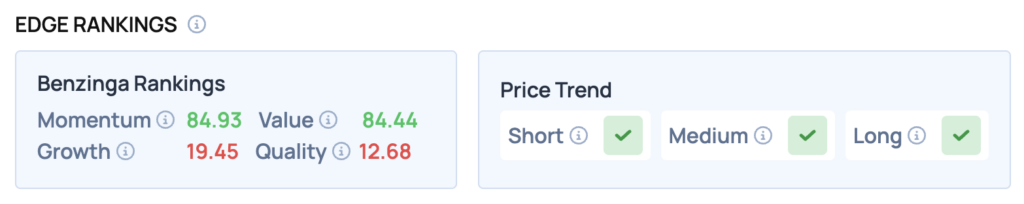

Benzinga Edge Rankings: Benzinga Edge data validates this bullish trend, highlighting a powerful Momentum score of 84.93 and a robust Value score of 84.44, indicating the stock is technically strong while remaining fundamentally attractive.

VALE Price Action: Vale shares were up 3.38% at $13.15 at the time of publication on Monday. The stock is approaching its 52-week high of $13.62, according to Benzinga Pro data.

As Vale approaches its 52-week high, it faces potential resistance at $13.62. A breakout above this level could signal further upside, potentially leading to new price targets.

Conversely, if the stock retraces, immediate support can be identified around $12.87, which aligns with the opening price on Monday, providing a cushion for any pullbacks.

Read Also: What’s Going On With Sidus Space Stock Today?

Image: Shutterstock

Recent Comments