Starbucks Corp. (NASDAQ:SBUX) on Friday named Anand Varadarajan its new chief technology officer, starting Jan. 19.

Varadarajan joins the world’s largest coffee chain from Amazon.com Inc. (NASDAQ:AMZN), where he spent nearly 19 years. Most recently, he led technology and supply chain for the e-commerce retailer’s global grocery stores business, which includes both its homegrown Fresh brand and Whole Foods. has also held software engineering roles at Oracle (NYSE:ORCL).

Turnaround Underway As Sales Pick Up

The move comes after Starbucks’ former CTO, Deb Hall Lefevre, left in September during a second round of layoffs and the rollout of a $1 billion restructuring plan.

“He knows how to create systems that are reliable and secure, drive operational excellence and scale solutions that keep customers at the center,” CEO Brian Niccol said in a memo to employees, adding that Varadarajan will report directly to him.

Since taking the helm in September 2024, Niccol has sought to rebuild the business through the “Back to Starbucks” initiative, which includes a series of major policy changes intended to improve the customer experience and return Starbucks to its glory as the “third place” customers spend time, other than at home and work. The company has already seen two rounds of sweeping layoffs and the closure of hundreds of stores as part of it.

In a sign that the changes are working, Starbucks posted its first quarter of gains in comparable sales after nearly a year and a half in late October, and holiday sales have also been strong so far this season as the company grapples with an ongoing strike of unionized baristas.

What’s Going On With SBUX Stock?

The coffee chain’s shares are down about 4.2% so far this year, at $88.33, according to Benzinga Pro data.

Recent developments indicate a mixed but gradually stabilizing backdrop: revenue trends have begun to strengthen, even as earnings remain pressured by labor and operational investments, and potential tariff relief, along with progress in the company’s China joint venture, have added cautious optimism.

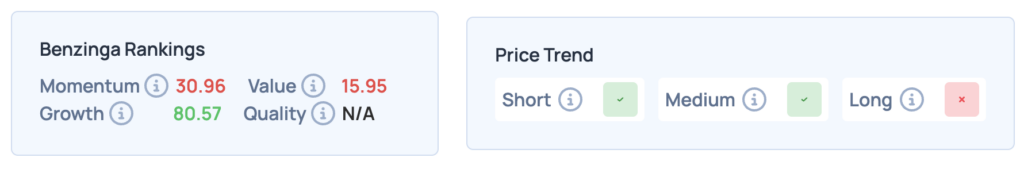

Benzinga’s proprietary Edge Rankings show growth as the strongest category for SBUX, while momentum and value are seen to be lagging. Short and medium-term price trends are also positive.

READ NEXT:

Image via Shutterstock

Recent Comments