FedEx Corp. (NYSE:FDX) posted upbeat financial results for the second quarter of fiscal 2026 and raised its FY2026 guidance on Thursday.

FedEx reported second-quarter revenue of $23.5 billion, beating analyst estimates of $22.79 billion, according to Benzinga Pro. The company posted second-quarter adjusted earnings of $4.82 per share, beating estimates of $4.11 per share.

“FedEx delivered an outstanding second quarter as we successfully executed our growth strategy and advanced our network transformation, while navigating a highly challenging external environment,” said Raj Subramaniam, president and CEO of FedEx.

FedEx now expects revenue to be up 5% to 6% in fiscal 2026, versus prior guidance for growth of 4% to 6%. The company also reaffirmed plans for permanent cost reductions of $1 billion from structural cost reductions and the advancement of Network 2.0.

FedEx also raised the low end of its adjusted earnings guidance from a range of $17.20 to $19 per share to a new range of $17.80 to $19 per share, versus estimates of $18.22 per share.

FedEx shares gained 0.1% to $287.39 on Friday.

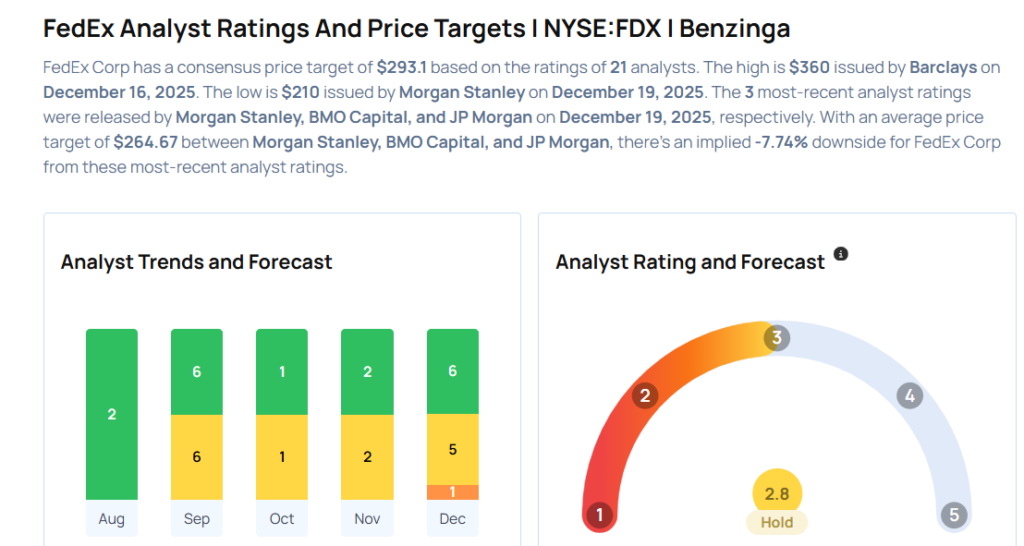

These analysts made changes to their price targets on FedEx following earnings announcement.

- B of A Securities analyst Ken Hoexter maintained FedEx with a Neutral and raised the price target from $285 to $315.

- Wells Fargo analyst Christian Wetherbee maintained the stock with an Equal-Weight rating and raised the price target from $290 to $295.

- Stifel analyst J. Bruce Chan maintained FedEx with a Buy and raised the price target from $305 to $328.

- Jefferies analyst Stephanie Moore maintained the stock with a Buy and raised the price target from $315 to $326.

- JP Morgan analyst Brian Ossenbeck maintained FedEx with a Neutral and raised the price target from $285 to $294.

- BMO Capital analyst Fadi Chamoun maintained the stock with a Market Perform and raised the price target from $265 to $290.

Considering buying FDX stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Recent Comments