KB Home (NYSE:KBH) reported upbeat fourth-quarter financial earnings after the market close on Thursday.

KB Home reported fourth-quarter revenue of $1.69 billion, beating analyst estimates of $1.66 billion, according to Benzinga Pro. The company reported fourth-quarter adjusted earnings of $1.92 per share, beating analyst estimates of $1.80 per share.

“Although housing market conditions remained challenging due to lower consumer confidence, affordability concerns and elevated mortgage interest rates, we were pleased to help nearly 13,000 individuals and families achieve the dream of homeownership during the year, while maintaining our industry-leading customer satisfaction ratings,” said Jeffrey Mezger, chairman and CEO of KB Home.

KB Home expects $1.05 billion to $1.15 billion in housing revenue in the first quarter. The company also guided for full-year 2026 housing revenue of $5.1 billion to $6.1 billion.

KB Home shares fell 9.3% to $56.92 on Friday.

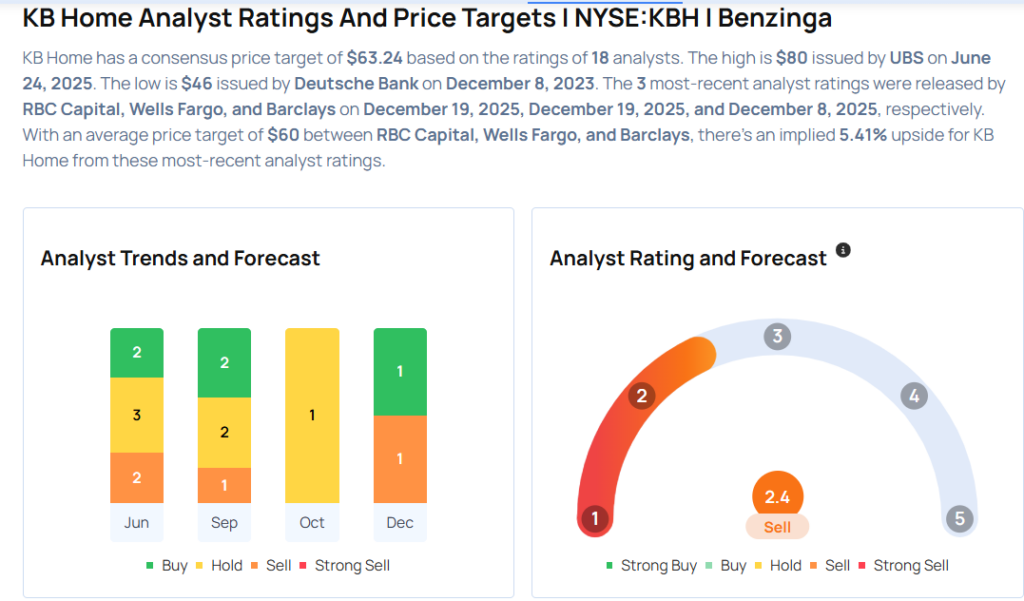

These analysts made changes to their price targets on KB Home following earnings announcement.

- Wells Fargo analyst Sam Reid maintained KB Home with an Underweight rating and lowered the price target from $60 to $55.

- RBC Capital analyst Mike Dahl maintained the stock with a Sector Perform and cut the price target from $59 to $54.

Considering buying KBH stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Recent Comments