U.S. stock futures are inching higher on Thursday after markets ended lower on Wednesday, amid growing concerns regarding a “hiring recession” following the November jobs report, which was released on Tuesday.

Traders and investors will be looking forward to the November Consumer Price Index, which is due later today, as a key inflation read that could provide the much-needed catalyst the markets need to set the tone for the final few trading days of the year.

Meanwhile, the 10-year Treasury bond yielded 4.13% and the two-year bond was at 3.46%. The CME Group’s FedWatch tool‘s projections show markets pricing a 73.4% likelihood of the Federal Reserve leaving the current interest rates unchanged.

| Futures | Change (+/-) |

| Dow Jones | 0.00% |

| S&P 500 | 0.31% |

| Nasdaq 100 | 0.68% |

| Russell 2000 | 0.17% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Wednesday. The SPY was up 0.23% at $672.95, while the QQQ advanced 0.55% to $603.70, according to Benzinga Pro data.

Stocks In Focus

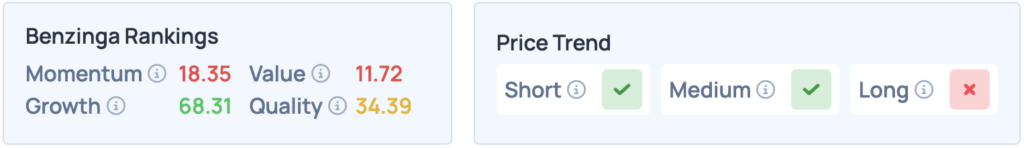

Accenture PLC

- Shares of Accenture Plc (NYSE:ACN) are down 0.27% overnight, ahead of the company’s fiscal first-quarter results before markets open on Thursday. Analysts expect the stock to report $3,75 per share in earnings, on revenue of $18.52 billion.

- The stock maintains a favorable price trend in the short and medium terms, while scoring high on Growth in Benzinga’s Edge Stock Rankings. Click here for deeper insights into the stock, its peers and competitors.

Micron Technology Inc.

- Semiconductor giant Micron Technology Inc. (NASDAQ:MU) is up 9.61% in overnight trade, following a better-than-expected first quarter performance, with a strong outlook for the second quarter.

- The stock scores high on Momentum, Growth and Quality in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for more insights into the stock, the company, its peers and competitors.

FedEx Corp.

- Shares of FedEx Corp. (NYSE:FDX) are down 0.07% pre-market, ahead of the company’s fiscal second-quarter results after markets close on Thursday. Analysts expect the company to post $4.10 per share in earnings, on revenue of $22.79 billion.

- The stock scores high on Growth and Value in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

MillerKnoll Inc.

- Furniture company, MillerKnoll Inc. (NASDAQ:MLKN) is up 7.02% overnight, following the company’s better-than-expected second-quarter performance, and robust guidance for the current quarter.

- The stock, however, does poorly in Benzinga’s Edge Stock Rankings, scoring high only on Value, with a favorable price trend in the short, medium and long terms. Click here for deeper insights into the stock, its peers and competitors.

Nike Inc.

- Nike Inc. (NYSE:NKE) shares are up 0.44% overnight, ahead of the company’s fiscal second-quarter results after markets close on Thursday. Leading analysts expect the company to post $0.38 per share in earnings, on revenue of $12.22 billion.

- The stock scores high on Growth in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short term. Click here for deeper insights into the stock, its peers and competitors.

Cues From Last Session

On Wednesday, Information Technology, Consumer Discretionary and Communication Services were in the green, while others saw declines, led by Energy, Health Care, Real Estate and Financials.

| Index | Performance (+/-) | Value |

| Nasdaq Composite | -1.81% | 22,693.32 |

| S&P 500 | -1.16% | 6,721.43 |

| Dow Jones | -0.47% | 47,885.97 |

| Russell 2000 | -1.07% | 2,492.29 |

Insights From Analysts

Amid growing concerns of a bubble in AI stocks, Ryan Detrick, the Chief Market Strategist at the Carson Group, said that any signs of trouble should first be visible in the credit markets, while noting that high-yield corporate bonds were “barely red” on Wednesday, and are “less than 1%” from their all-time highs.

According to Detrick, “If there really was a monster under the bed, we’d see it in credit.” This comes despite companies such as Oracle Corp. (NYSE:ORCL) having witnessed significant widening in their credit default swap spreads, due to increasing AI-related borrowing.

Upcoming Economic Data

Here’s what investors will be keeping an eye on Thursday,

- Initial jobless claims for the week ended Dec. 13 will be released at 8:30 a.m. ET, alongside the November consumer price index report. Markets will be watching headline CPI, core CPI, and year-over-year inflation readings for fresh signals on price pressures.

- Also at 8:30 a.m. ET, the Philadelphia Fed will publish its manufacturing survey for December, offering an updated read on regional factory activity.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 0.65% to hover around $56.17 per barrel.

Gold Spot US Dollar was down 0.23% to hover around $4,327.50 per ounce. Its last record high stood at $4,381.6 per ounce. The U.S. Dollar Index spot was up 0.12% at the 98.122 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.88% higher at $86,958 per coin.

Asian markets closed mixed on Thursday, with only Hong Kong’s Hang Seng Index, China’s Shanghai, and Australia’s ASX firmly in the green, with others ending lower. Most European markets have opened higher in early trade.

Read More:

Photo courtesy: Shutterstock

Recent Comments