Jim Cramer has predicted that Palantir Technologies Inc. (NASDAQ:PLTR) will soar to $200, following its recent surge past $150.

Check out the PLTR stock price here.

What Happened: In a post on X, CNBC’s ‘Mad Money’ host Cramer described the stock’s upward movement as “like a knife through butter,” signaling a bullish outlook on the AI-driven data analytics firm.

Palantir, known for its Gotham and Foundry platforms used by U.S. defense and commercial sectors, hit a fresh record high of $160.39 per share intraday on Friday.

Last week, the U.S. Army awarded a $100 million contract to the Anduril-Palantir team for the delivery of a Next-Generation Command and Control (NGC2) platform prototype.

With this deal, Palantir is poised to secure an estimated $30 million from an 11-month contract, a high-priority U.S. Army project, reported Insider Monkey, citing William Blair analyst Louie DiPalma.

This initiative also offers the potential to boost Palantir’s annual recurring revenue by over $150 million within three years.

Wedbush analyst Dan Ives also highlighted Palantir as a key beneficiary of President Donald Trump‘s “AI Action Plan,” which aims to secure U.S. leadership in the sector, and he also listed it as one of his top five picks for the second half of 2025.

Why It Matters: Additionally, last week on Friday, Piper Sandler analyst Brent Bracelin announced a $170 price target for Palantir.

This followed Ives’ target price increase to $160 apiece, underlining the growing confidence in Palantir’s artificial intelligence strategy. He described PLTR to be on a “golden path to become an AI stalwart” over the next 12 months.

The enthusiasm of various analysts underscores their belief in the company’s potential to dominate the AI landscape, despite its forward P/E ratio of 277.778, raising valuation concerns among some investors.

While bullish analysts like Ives and Bracelin are raising their targets, the broader analyst consensus of 25 experts, as tracked by Benzinga, remains a ‘Sell’ with an average price target near $80.6. Despite this, investor sentiment, propelled by key government contracts and strategic enterprise partnerships, continues to drive the stock to new heights.

Price Action: Palantir was up 1.41% in premarket on Monday. It has risen by 111.20% on a year-to-date basis and 486.41% over the past year.

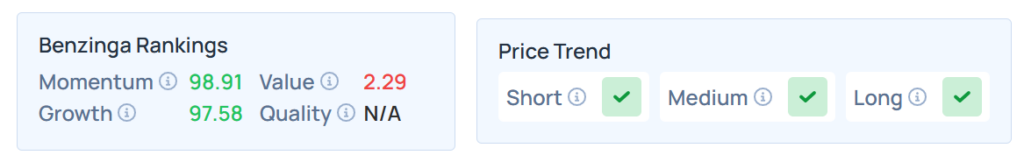

Benzinga’s Edge Stock Rankings indicate that PLTR maintains solid momentum across short, medium, and long-term periods. However, while the stock scores well on growth rankings, its value rating remains relatively weak. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Monday. The SPY was up 0.18% at $638.23, while the QQQ advanced 0.37% to $568.47, according to Benzinga Pro data.

Read Next:

Image via Shutterstock

Recent Comments