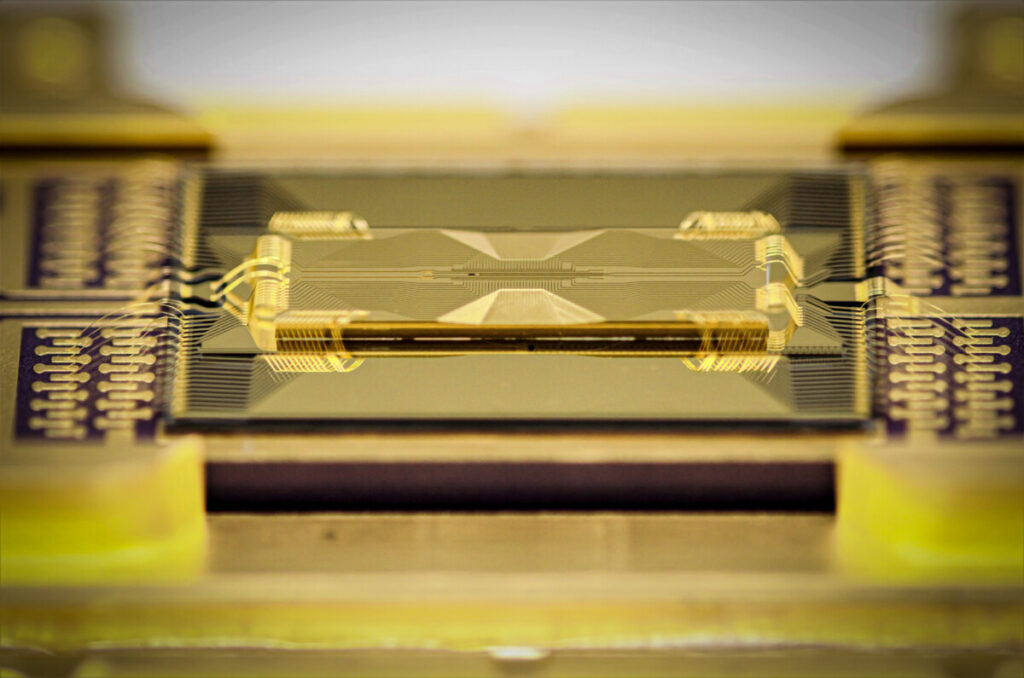

Trapped-ion computing processor. Used with permission: IonQ.

Quantum computing has arrived. IonQ (NYSE:IONQ), a leading commercial quantum computing and networking company, is shipping quantum computers and networks, growing at an almost 100% YoY pace, as well as selling and winning deals at over $44 a share. Ironically, it seems that the market hasn’t fully grasped that yet. They’re still thinking of massive lab prototypes and expensive sub-Kelvin dilution refrigerators, while IonQ is bringing live systems to paying customers worldwide.

Selling full quantum systems, while scaling from the cloud to the planet

IonQ systems run on AWS Braket, Azure Quantum and Google Quantum AI Cloud. That makes at least three major public clouds. No other quantum vendor matches that reach. Through its strategic organic and inorganic expansion, IonQ operates in Asia, EU, Canada, UK and America. That global network footprint isn’t experimental. The company’s commercial infrastructure leverages hyperscalers, telecom and defense-adjacent applications.

And they didn’t stumble into this, they systematically assembled it. They bought Lightsynq in June to further expand their photonic interconnect and quantum memory capabilities. “With this acquisition, we’re accelerating our development timeline to fault tolerant quantum computers and long distance networking capabilities,” CEO Niccolo de Masi said during an exclusive interview.

The acquired Lightsync technology allows IonQ to provide optimized compute capabilities over thousands of kilometers. He said Lightsynq latency shifts from about 55 milliseconds to two seconds, which is a 97% improvement, letting entanglement persist long enough for even more complex real-world applications to run. That’s not hypothetical puffery, it’s architectural muscularity.

They also inked a $22 million deal with EPB to establish a quantum hub in Chattanooga offering Forte Enterprise and networking training for grid optimization. That marks the first U.S. quantum computing and networking center complete with a new IonQ office.

This is an acquisition spree with strategy

In addition to buying Lightsynq, IonQ is now the majority shareholder of ID Quantique to beef up their Swiss-grade quantum networking capabilities. They announced the Capella Space acquisition to take quantum key distribution systems into orbit, creating a secure satellite-ground quantum internet. Most recently they agreed to buy Oxford Ionics for $1.075 billion, gaining OI’s complementary ion-trap breakthrough tech and UK R&D depth.

Add it up. They’re assembling compute, memory, networking, satellite and cloud access into one commercial platform. That’s a full tech stack, vertically integrated. IonQ is one of the biggest, if not the biggest, public-quantum movers by acquisition count with an IP portfolio of almost 1000 owned and controlled patents.

AQ is the metric that actually matters

IonQ talks algorithmic qubits, AQ, rather than inflated raw qubit counts. Their Forte and Forte Enterprise quantum systems hit AQ 36. While the next-gen Tempo quantum systems will target AQ 64 by the end of 2025.

“AQ 64 is an important milestone for our industry. Even a data center packed with classical GPUs couldn’t keep up with a single AQ 64 machine when trying to exactly simulate its quantum circuits. Especially for small-scale versions of factoring, decryption, optimization or linear-algebra workloads,” explained de Masi.

AQ signals usable compute power, not just hardware specs. It integrates error rates, fidelity, connectivity and circuit depth. It’s performance that users can build with. And they’re already delivering.

Software simulation leader Ansys saw a 12% speed-up on heart-pump simulations, and IonQ’s work with AstraZeneca, AWS and Nvidia cut drug-discovery interference times by 20x. These are real customer benchmarks.

Niccolo de Masi, IonQ CEO and Cambridge-trained physicist. Used with permission: IonQ.

Quantum networking is the subplot few are pricing in

Compute grabs headlines. Networking unlocks scale. IonQ leads here. “We are the only public quantum networking company in the world,” de Masi said.

IonQ is building quantum repeaters via Lightsynq. Capella Space extends links to satellites and back to earth. EPB in Tennessee gives grid-scale metropolitan hubs. ID Quantique expands the quantum networking capabilities and backbone. That adds up to a real quantum internet. Encryption, finance, defense and satellite operations are all sectors IonQ is positioning to serve through secure networks.

“We have an exceptional opportunity to accelerate our vision for the quantum internet through our announced acquisitions of LightSynq and Capella,” De Masi said. That’s ambition backed by capital and hardware.

Miniaturization and energy-efficient design

Quantum systems usually require bulky cryogenic setups. IonQ has been pushing room-temperature, vacuum-less parts that reduce weight, cost and power use. They’re moving toward modular, replaceable components that match data center readiness. It’s also about building a compute, networking and applications ecosystem smartly, not just building massive server farms with extreme climate controls and state-mandated, co-located power stations.

“This is the quantum computing industry, not the quantum construction business. Never in the history of computing has anything other than smaller and cheaper won. Additionally, quantum computers run on a fraction of the electricity of classical supercomputers, and in some instances quantum is 100x more energy efficient than traditional compute, ” de Masi said.

That’s not theoretical. It’s operational.

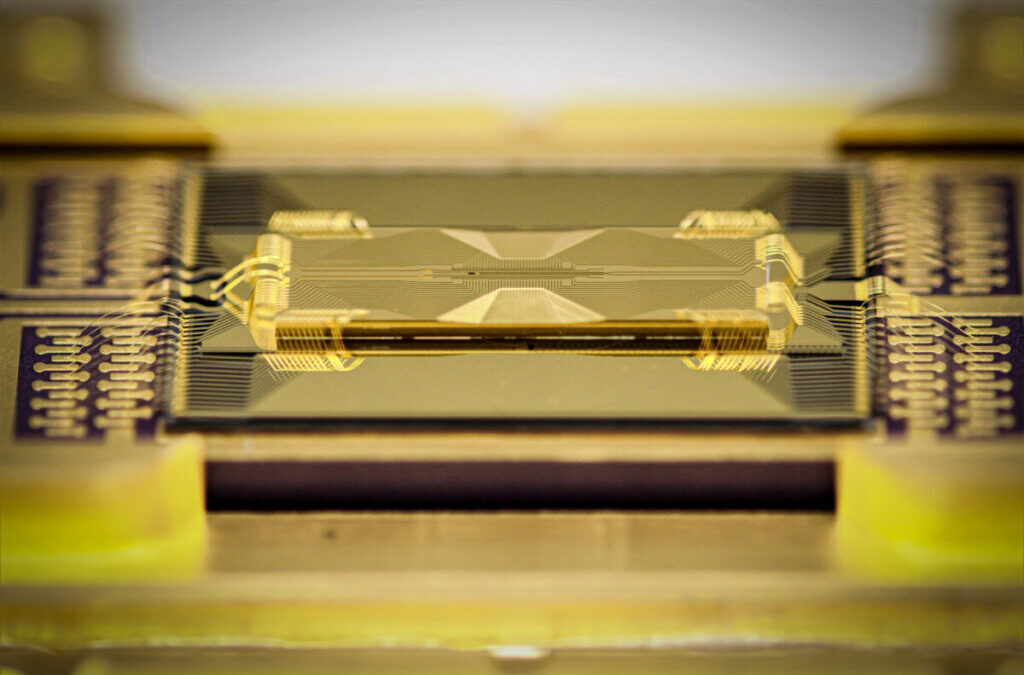

IonQ engineer holding a test wafer of dozens of quantum processors. Used with permission: IonQ.

Financial strength and capital to execute

IonQ recently priced a $1 billion equity raise at $55.49 a share, that’s more than a 25% premium over the prior market closing price, lifting cash to $1.68 billion. That’s one of the largest single-investor deals in quantum history. Benchmark and Cantor called it confirmation of IonQ’s differentiated commercial model across hardware, services and applications.

While still pursuing profitability, its Q1 revenue came in above guidance. Cash sat at nearly $750 million. Hyundai, Airbus, Air Force Research Lab, EPB, University of Maryland and AWS are all paying or paid to use IonQ’s the tech. Based on IonQ’s earnings disclosures and expansion activity, the capital appears targeted toward scaling compute, networking and commercial systems.

The entire company is its competitive moat

IonQ is unique within the pure-play quantum computing space. Acquisitions, cloud reach, engineering, hardware, networking, satellite and workforce hubs. Patent depth. Customer results. Cash. Its technical roadmap.

“Every day we get up in the morning knowing that we can impact every area of applied science,” De Masi told me. “Whether it’s drug discovery or defense and intelligence or logistics or material science, we impact everything.”

IonQ’s execution speaks louder than its pure-play quantum computing competitors. That’s what sets them apart.

Do your own research, you’ll see what the “smart money” sees

These are obviously personal opinions; not financial advice. Anyone considering investing in any asset needs to do their own research and understand the risks associated with emerging tech such as quantum computing. While I no longer own any shares of IonQ, when I sold my entire stake in mid-December 2024 I turned a 340% profit. That was the best performing equity asset in my portfolio. And based on all the publicly available information about this company; it’s still a banger with room to run.

The latest sale to Heights Capital Management of more than 14 million IonQ shares at a 25% markup with the seven-year option of buying another 36 million shares at $99.88 each is a resounding vote of confidence from Wall Street sharps regarding IonQ’s potential upside.

Quantum isn’t five years away. It’s crossing into reality with commercial contracts, live networks and satellite integration underway. IonQ is the stock that reflects that. Not early-stage theory. Not hype. Just results.

Recent Comments