On Thursday, Advanced Micro Devices, Inc. (NASDAQ:AMD) unveiled a new server, signaling a direct challenge to Nvidia Corporation’s (NASDAQ:NVDA).

What Happened: At a development conference called “Advancing AI” in San Jose, AMD CEO Lisa Su introduced the Helios AI server, set to launch in 2026.

Each Helios unit will contain 72 MI400 chips, directly rivaling Nvidia’s NVL72 system.

The shift reflects a change in competition among AI chipmakers like Nvidia, moving beyond selling standalone chips to offering complete server systems containing dozens or even hundreds of processors, all integrated with networking components from the same vendor.

See Also: Robinhood Stock Is Falling Monday: What’s Going On?

“The future of AI is not going to be built by any one company or in a closed ecosystem. It’s going to be shaped by open collaboration across the industry,” Su said.

AMD also said that Helios’ networking standards would be openly shared with competitors like Intel Corporation (NASDAQ:INTC).

OpenAI CEO Sam Altman joined Su onstage and said that ChatGPT would use AMD’s MI450 chips, stating, “Our infrastructure ramp-up over the last year, and what we’re looking at over the next year, have just been a crazy, crazy thing to watch.”

Executives from Meta Platforms Inc. (NASDAQ:META), xAI, and Oracle Corporation (NYSE:ORCL) took the stage to highlight how they’re leveraging AMD processors in their operations.

Why It’s Important: Last month, Bank of America analyst Vivek Arya maintained a Buy rating on AMD with a $130 price target, citing the company’s gains in server and PC CPU market share, growing AI opportunities and multi-year contracts in the Middle East.

While Nvidia and custom chips are expected to lead the AI accelerator market, Arya sees AMD capturing a 3–4% share of the $300–$400 billion market.

He highlighted AMD’s strategic acquisitions, software improvements and recognition from companies like Oracle and xAI. Arya also forecasted up to $6.6 billion in additional revenue across key segments by 2027.

Price Action: AMD shares have declined 1.77% year-to-date and are down 25.89% over the past 12 months. On Thursday, the stock fell 2.18%, closing at $118.50, according to Benzinga Pro.

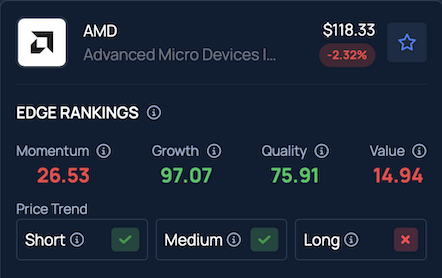

Benzinga’s Edge Stock Rankings indicate AMD continues to show strong upward momentum in the short and medium term, but trends downward over the long term. Additional performance insights are available here.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo Courtesy: jamesonwu1972 On Shutterstock.com

Recent Comments