U.S. stock futures rose on Friday after closing lower on Thursday. Futures of all the major benchmark indices were positive.

Wall Street is waiting for the fourth-quarter GDP data, scheduled for release later today, along with the Federal Reserve’s preferred inflation gauge, the Personal Consumption Expenditure Price Index.

Meanwhile, President Donald Trump on Thursday warned Iran it must strike a deal on its nuclear program within 10 to 15 days or face “really bad things,” prompting Tehran to threaten retaliation against U.S. bases across the Middle East if it is attacked.

The 10-year Treasury bond yielded 4.07%, and the two-year bond was at 3.47%. The CME Group’s FedWatch tool‘s projections show markets pricing a 94% likelihood of the Federal Reserve leaving the current interest rates unchanged in March.

| Index | Performance (+/-) |

| Dow Jones | 0.26% |

| S&P 500 | 0.37% |

| Nasdaq 100 | 0.47% |

| Russell 2000 | 0.34% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Friday. The SPY was up 0.41% at $687.26, while the QQQ advanced 0.50% to $606.50.

Stocks In Focus

Dropbox

- Dropbox Inc. (NASDAQ:DBX) fell 4.16% in premarket on Friday despite posting better-than-expected fourth-quarter earnings. The company also said it sees FY2026 sales of $2.485 billion to $2.500 billion, versus market estimates of $2.494 billion.

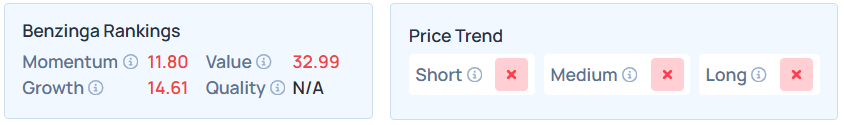

- DBX maintains a weaker price trend over the long, short, and medium terms, with a poor growth ranking, as per Benzinga’s Edge Stock Rankings.

Copart

- Copart Inc. (NASDAQ:CPRT) dropped 6.64% after posting downbeat earnings for the second quarter. It reported quarterly earnings of 36 cents per share, which missed the consensus estimate of 40 cents.

- CPRT maintains a weak price trend over the short, medium, and long terms with a solid quality ranking, as per Benzinga’s Edge Stock Rankings.

Comfort Systems US

- Comfort Systems USA Inc. (NYSE:FIX) rose 4.57% after reporting better-than-expected fourth-quarter financial results and raising its quarterly dividend.

- FIX maintains a stronger price trend over the short, medium, and long terms, with a poor value ranking, as per Benzinga’s Edge Stock Rankings.

Grail

- Grail Inc. (NASDAQ:GRAL) plunged 47.04% following its fourth quarter and full year earnings with revenue of $41.3 million and net loss of $99.2 million, which includes amortization of Illumina acquisition-related intangible items of $34.6 million.

- Benzinga’s Edge Stock Rankings indicate that GRAL maintains a weaker price trend over the short, medium, and long terms.

Candel Therapeutics

- Candel Therapeutics Inc. (NASDAQ:CADL) declined 12.27% after announcing the pricing of a $100 million public stock offering.

- Benzinga’s Edge Stock Rankings indicate that CADL maintains a weak price trend over the long, medium, and short terms.

Cues From Last Session

On Thursday, Utilities led the gains with a 1.13% increase as investors sought defensive assets, while Financials suffered the steepest decline, dropping 0.86%.

| Index | Performance (+/-) | Value |

| Dow Jones | -0.54% | 49,395.16 |

| S&P 500 | -0.28% | 6,861.89 |

| Nasdaq Composite | -0.31% | 22,682.73 |

| Russell 2000 | 0.24% | 2,665.09 |

Insights From Analysts

Scott Wren, Senior Global Market Strategist at Wells Fargo Investment Institute, maintains a bullish outlook on the U.S. economy, recently upgrading the GDP growth forecast to 2.9% from 2.4%. Despite the current caution in the market following recent volatility, Wren argues that the current environment is a “robust pace for the world’s largest economy”.

Rather than retreating into defensive assets, Wren recommends leaning into sectors sensitive to this growth. He specifically identifies Financials and Industrials as top picks.

Wren notes that Industrials are uniquely positioned to benefit from the “artificial intelligence (AI) infrastructure buildout,” which requires significant upgrades to data centers and the electrical grid. While acknowledging that a midterm election year often brings turbulence, Wren views these dips as entry points:

“In our view, pullbacks are opportunities to step into large- and mid-cap domestic equities in favored sectors”. Ultimately, he rejects the popular move toward safety, stating firmly, “We do not favor defensive positioning”.

Upcoming Economic Data

Here’s what investors will be keeping an eye on Friday.

- The fourth quarter GDP number, December’s personal income, spending, headline, and core PCE data will be out by 8:30 a.m. ET.

- February’s S&P flash U.S. services and manufacturing PMI will be released by 9:45 a.m., November and December’s delayed new home sales report, and February’s preliminary consumer sentiment data will be out by 10:00 a.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading lower in the early New York session by 0.39% to hover around $66.14 per barrel.

Gold Spot US Dollar rose 0.89% to hover around $5,040.69 per ounce. Its last record high stood at $5,595.46 per ounce. The U.S. Dollar Index spot was 0.11% lower at the 97.5940 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 1.65% higher at $68,103.42 per coin.

Asian markets closed lower on Friday, except South Korea’s Kospi and India’s Nifty 50 indices. Japan’s Nikkei 225, China’s CSI 300, Australia’s ASX 200, and Hong Kong’s Hang Seng indices closed lower. European markets were mostly higher in early trade.

Photo courtesy: Shutterstock

Recent Comments