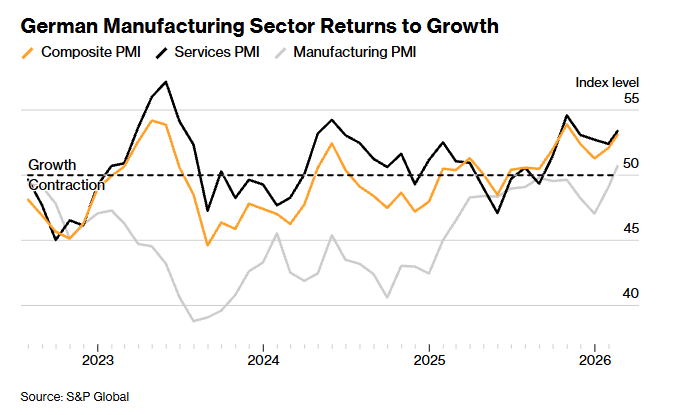

Germany’s manufacturing sector expanded for the first time since 2022, giving Europe’s biggest economy a lift as increased government spending helped support activity.

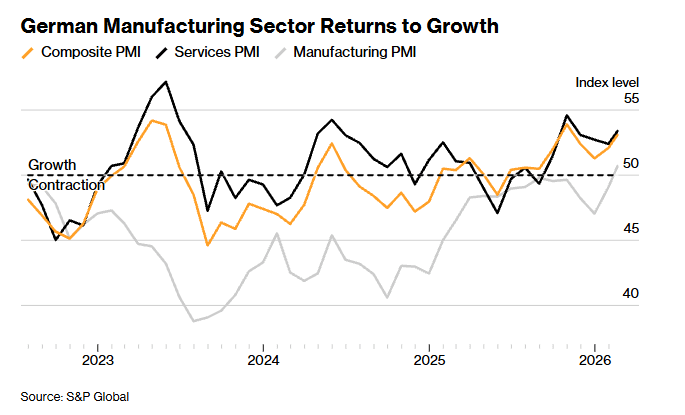

S&P Global Manufacturing Purchasing Managers’ Index advanced to 50.7 in February from 49.1 the previous month. This surpassed the 50‑point threshold separating expansion from contraction, ending a slump that’s curbed growth and jobs, S&P Global said on Friday.

The HCOB Flash Germany Composite PMI Output Index registered at 53.1 in February, up from 52.1 in January and the highest reading since last October. Growth continued to be led by the service sector, where the rate of expansion in business activity quickened to a four-month high, S&P Global reported.

“German industry is growing again,” Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said in a statement on Friday.

“This confirms the tentative signs of an economic turnaround that were particularly evident in January. It is particularly encouraging that new orders have risen robustly, suggesting that production growth will continue in the coming months.”

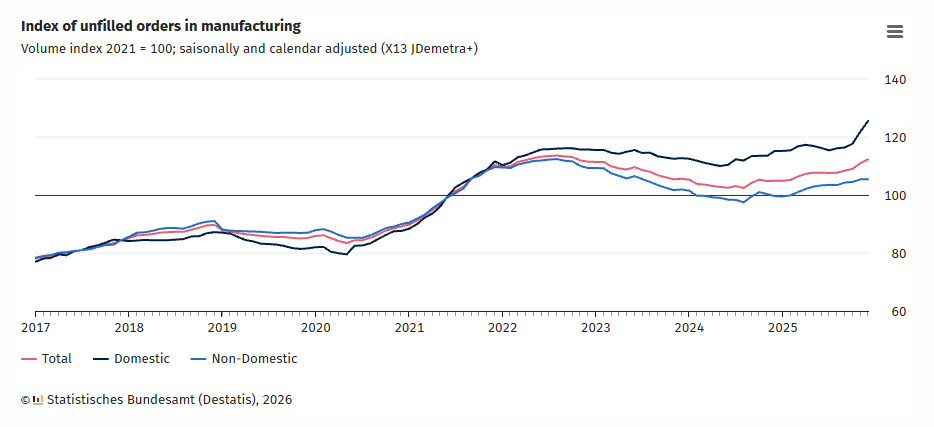

Stock Orders Increase

Germany’s real (price‑adjusted) manufacturing order backlog rose 1.2% in December from November after seasonal and calendar adjustment, the Federal Statistical Office (Destatis) said on Thursday. The calendar‑adjusted backlog was 7.0% higher than a year earlier.

“Higher new orders from abroad, which have risen again after six months of decline, have also helped here,” de la Rubia said. “We expect the government’s infrastructure program and higher military spending to provide increasing tailwinds for industry.”

Stronger output in transport equipment — including aircraft, ships, trains and military vehicles — drove the increase in manufacturing order backlogs in December. Higher production of fabricated metal products, excluding machinery and equipment, also contributed.

Backlogs of work rose for the first time since May 2022, according to S&P Global. Employment continued to decline, though the pace of job losses was the second slowest in almost two-and-a-half years.

S&P Global’s PMI is based on original survey data collected from a representative panel of around 800 companies based in the German manufacturing and service sectors. It is watched closely by markets as they arrive early in the month and are good at revealing trends and turning points in an economy, according to Bloomberg News.

German Economic Turnaround

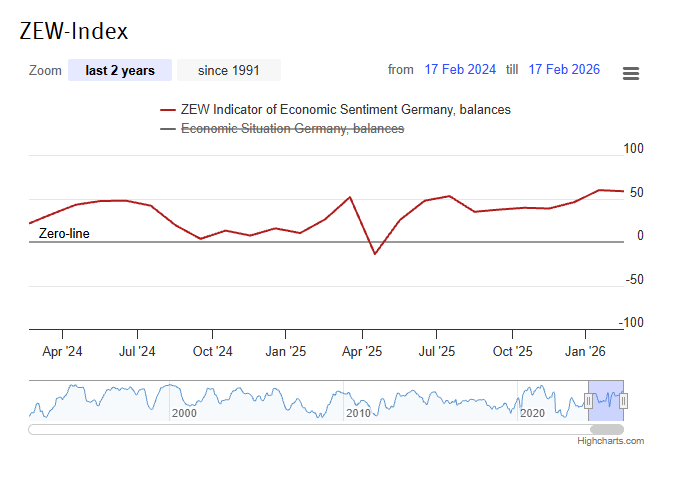

Despite the strong positive turnaround, the German economy remains fragile, and broader economic sentiment underlines the mixed backdrop.

Expectations about Germany’s economic situation dropped 1.3 points in February to plus 58.3 points from the previous month, according to the ZEW Indicator of Economic Sentiment on Tuesday.

The assessment of the current economic situation has improved. The indicator for Germany increased by 6.8 points, compared to the previous month and reaching minus 65.9 points.

“The ZEW Indicator remains stable,” ZEW President Professor Achim Wambach said after the current survey. “The German economy has entered a phase of recovery, albeit a fragile one. There are still considerable structural challenges, especially for industry and private investment.”

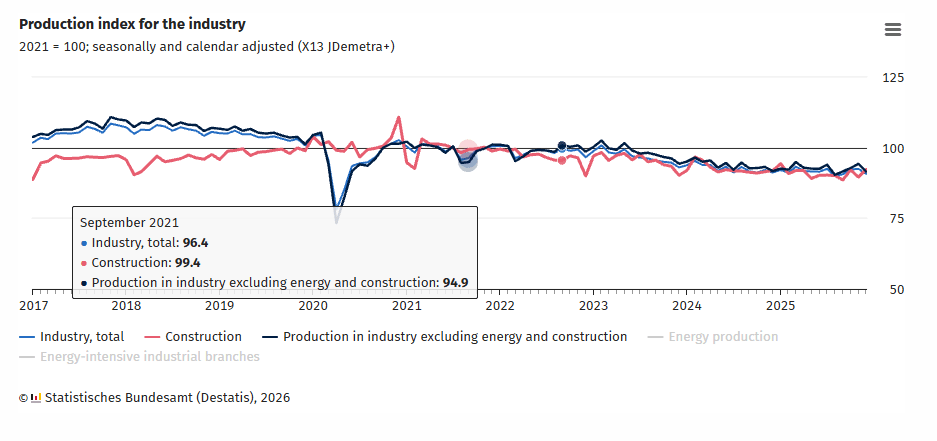

Germany’s economy grew by 0.2% in 2025, breaking two consecutive years of recession, despite headwinds related to its shipments to the US and China. German factory output in 2025 fell for the third year, down 1.3%. The automotive industry and the manufacture of machinery and equipment recorded losses from stiffer competition in global markets.

US tariffs, a stronger euro, and increased Chinese competition have curbed Germany’s exports, with fewer motor vehicles, trailers and semi-trailers, machines, and chemical products shipped abroad.

Bundesbank Issues Warning

The Bundesbank said on Thursday that the country’s economy will continue to recover, although expansion in the first quarter will be weak. The rate of growth will pick up from the spring, the Bundesbank said in a monthly economic report.

The central bank earlier forecast German economic growth below 1% this year with most of that growth skewed towards the second half of the year. Higher government spending on defense and infrastructure drove the increase in large orders, according to the Bundesbank.

German industrial production fell 1.9% in December from the previous month in price‑adjusted terms, after seasonal and calendar adjustment, according to Destatis on February 6. Output in the three months through December was 0.9% higher than in the prior three‑month period.

German Chancellor Friedrich Merz warned in January that the situation in the country’s industry “is very critical.” He also cautioned on February 12 that “overall productivity of our national economy is not high enough.”

Merz blamed productivity weakness on Germany’s work culture.

“Work-life balance and a four-day week will not be enough to maintain our country’s current level of prosperity in the future, which is why we need to work harder,” he said during a recent speech to industry groups in eastern Germany.

Disclaimer: Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

.

Recent Comments