United Airlines Holdings Inc (NASDAQ:UAL) shares are trading lower Thursday morning as crude oil extended gains to roughly six-month highs. Here’s what investors need to know.

- United Airlines stock is among today’s weakest performers. What’s weighing on UAL shares?

Geopolitical Risk Premium Returns

Oil moved up after U.S.–Iran nuclear talks in Geneva hit a stalemate and both sides signaled tougher military posturing, pushing traders to add a geopolitical “risk premium” back into crude benchmarks.

Brent climbed around 1.5% to the low-$70s, with WTI above $66, continuing a year-to-date advance driven largely by supply fears rather than demand.

Why Higher Oil Prices Pressure United’s Stock

Fuel is one of United’s largest variable expenses. When crude approaches multi-month highs, jet fuel prices usually follow with a lag, raising United’s cost per available seat mile. Because tickets are often sold months in advance, United can’t immediately reprice its inventory, so rising fuel flows straight into lower profit margins.

Even if management uses hedging or fuel-saving initiatives, sharp upside moves in crude tend to outpace these protections, squeezing earnings expectations and weighing on the stock’s valuation multiple.

To offset higher fuel, United would ultimately need to raise fares or cut capacity. Both actions risk dampening demand just as consumers face broader macro uncertainty.

Lower projected profits, combined with elevated market volatility tied to Middle East tensions, leaves UAL shares vulnerable as traders could rotate toward companies less exposed to energy price spikes.

Shares Remain Above Key SMAs

UAL stock is trading 2.1% above its 20-day simple moving average (SMA) but is 0.9% above its 50-day SMA, indicating some short-term strength.

Over the past 12 months, shares have increased 5.27% and are currently positioned closer to their 52-week highs than lows.

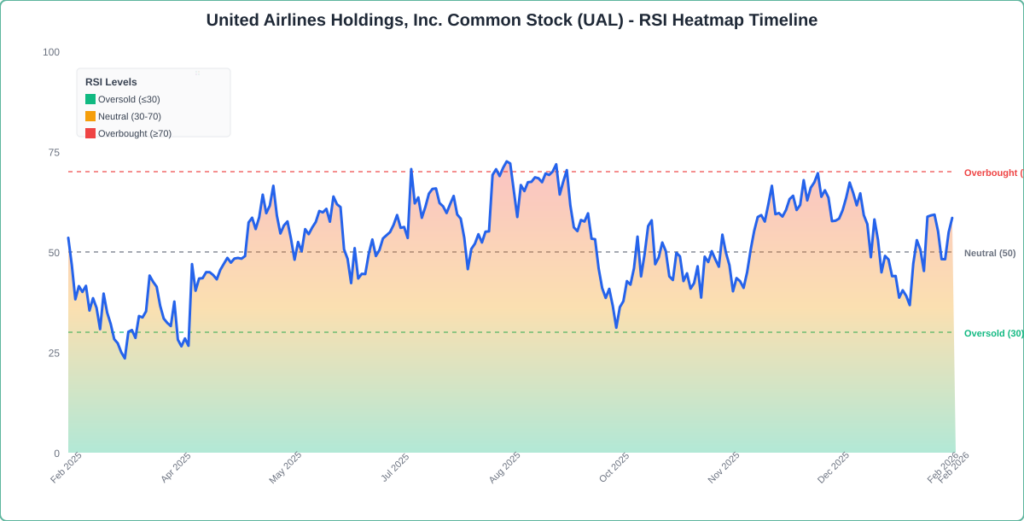

The RSI is at 58.23, which is considered neutral territory. Meanwhile, MACD is at 1.0683, above its signal line at 0.4677, indicating bullish momentum.

The combination of neutral RSI and bullish MACD suggests mixed momentum.

- Key Resistance: $119.00

- Key Support: $110.50

Wall Street’s Bullish Outlook

Analyst Consensus & Recent Actions: The stock carries a Buy Rating with an average price target of $135.71. Recent analyst moves include:

- TD Cowen: Buy (Raises Target to $140.00) (Jan. 22)

- UBS: Buy (Raises Target to $147.00) (Jan. 22)

- Argus Research: Buy (Lowers Target to $135.00) (Jan. 22)

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for United Airlines Holdings, highlighting its strengths and weaknesses compared to the broader market:

- Value Rank: 82.37 — The stock is showing strong value relative to its peers.

- Growth Rank: 86.44 — Indicates solid growth potential in the current market.

- Momentum Rank: 48.89 — Suggests the stock is performing moderately in terms of momentum.

The Verdict: United Airlines’ Benzinga Edge signal reveals a strong growth and value proposition in the current market. The high ranks suggest that the stock is well-positioned for future performance, making it an attractive option for investors.

UAL Shares Slide Thursday

UAL Price Action: United Airlines Holdings shares were down 3.50% at $112.84 at the time of publication on Thursday. Despite Thursday’s losses, the stock is still trading near its 52-week high of $119.21, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments