As of Feb. 19, 2026, two stocks in the industrials sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here’s the latest list of major overbought players in this sector.

FedEx Corp (NYSE:FDX)

- FedEx recently hosted its 2026 Investor Day. The company aims to enhance its position as a leader in the global industrial network by focusing on premium growth sectors, expanding its digital and AI capabilities, and transforming its operations to boost profitability and shareholder value. The company’s stock gained around 27% over the past month and has a 52-week high of $383.59.

- RSI Value: 86.7

- FDX Price Action: Shares of FedEx gained 2.1% to close at $383.08 on Wednesday.

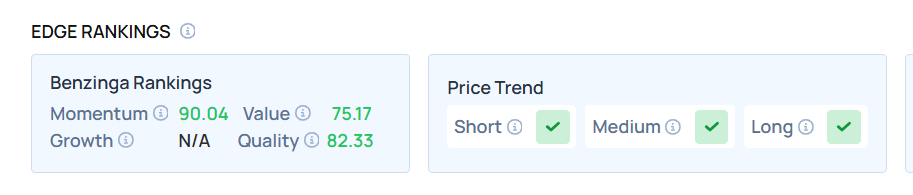

- Edge Stock Ratings: 90.04 Momentum score with Value at 75.17.

Modine Manufacturing Co (NYSE:MOD)

- On Feb. 4, Modine Manufacturing posted better-than-expected quarterly earnings. “Modine delivered another quarter of outstanding performance, with 21 percent organic sales growth driven by a 78 percent increase in data center sales,” said Modine President and Chief Executive Officer, Neil D. Brinker. The company’s stock gained around 60% over the past month and has a 52-week high of $235.02.

- RSI Value: 81.7

- MOD Price Action: Shares of Modine Manufacturing rose 0.3% to close at $217.53 on Wednesday.

BZ Edge Rankings: Find out where other stocks stand—explore the full comparison now.

Photo via Shutterstock

Recent Comments