Red Cat Holdings Inc (NASDAQ:RCAT) shares are trading higher Thursday morning as investors rotate back into defense and surveillance names tied to rising U.S.–Iran tensions. The small-cap drone stock is adding to recent gains.

- Red Cat Holdings stock is surging to new heights today. What’s fueling RCAT momentum?

Iran Tensions Drive Fresh Bid For Defense Drones

Thursday’s march higher in Red Cat stock adds to gains of more than 16% over the past week. This week’s move follows reports the U.S. is edging closer to potential military action against Iran, including a buildup of carriers, warships and fighter jets. Prediction markets have been steadily increasing the odds of a strike within weeks.

Separate coverage of stalled Iran–U.S. nuclear talks in Geneva and renewed saber-rattling has pushed crude benchmarks higher as traders reprice geopolitical risk. The same headlines are reviving interest in small-cap defense names seen as beneficiaries of higher spending and reconnaissance demand.

RCAT Extends Sector Rally On Conflict Hedging

RCAT, a provider of unmanned systems and drone technology for military and government customers, is extending gains after rallying alongside peers on Wednesday, when it jumped more than 8% during a broad defense-sector surge.

Further signs of diplomatic deadlock or new deployments could keep speculative interest elevated in RCAT, but volatility is likely to remain high as Iran headlines evolve.

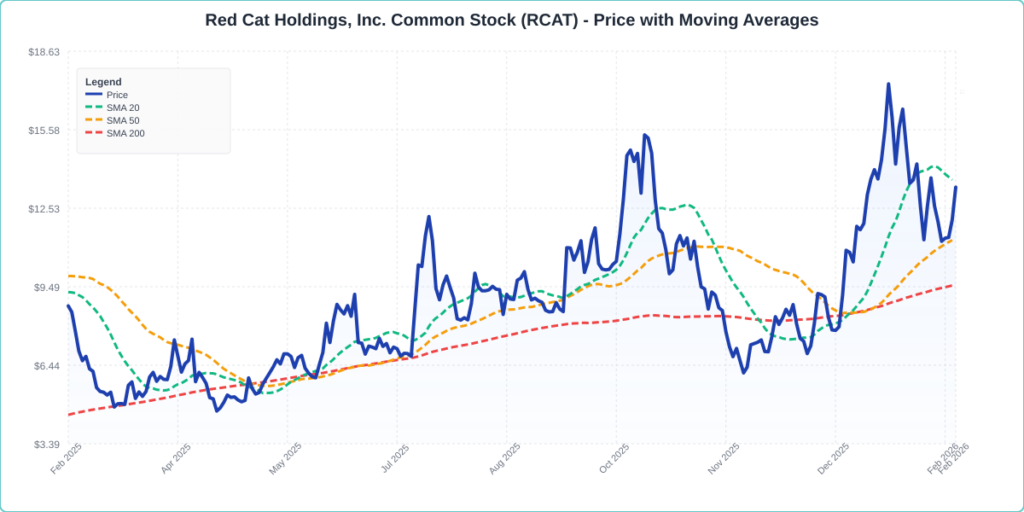

RCAT Stock Shows Mixed Moving Average Signals

Currently, the stock is trading 2.1% below its 20-day simple moving average (SMA) but is 24.6% above its 100-day SMA, demonstrating longer-term strength.

Over the past 12 months, shares have increased by 52.98%, and they are currently positioned closer to their 52-week highs than lows.

The RSI is at 48.26, which is considered neutral territory. Meanwhile, MACD is at -0.1075, below its signal line at 0.3104, indicating bearish pressure on the stock.

The combination of neutral RSI and bearish MACD suggests mixed momentum, indicating that while the stock is not currently overbought or oversold, there is some bearish pressure to consider.

- Key Resistance: $14.00

- Key Support: $11.00

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Red Cat Holdings, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Bullish (Score: 82.32) — Stock is outperforming the broader market.

The Verdict: Red Cat Holdings’ Benzinga Edge signal reveals a strong momentum setup, indicating that the stock is well-positioned for continued growth in a favorable market environment. Investors should keep an eye on upcoming earnings and market developments that could further influence the stock’s trajectory.

RCAT Shares Surge Thursday

RCAT Price Action: Red Cat Holdings shares were up 8.69% at $13.14 at the time of publication on Thursday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments