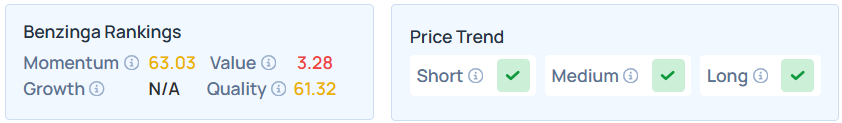

Coca-Cola Co. (NYSE:KO) has seen its Benzinga Edge value score plummet from 17.86 to a bottom-tier 3.28 in a single week as the stock gained 15% year-to-date, following its fourth quarter 2025 earnings report.

Coca-Cola’s Value Score Drops

This sharp decline in the percentile-ranked metric, which compares market price to fundamental assets and earnings, suggests the stock is now heavily overvalued following its YTD price surge.

Despite maintaining a relatively healthy quality score of 61.32 and strong price trends across all timeframes as per Benzinga Edge’s Stock Rankings, investors are souring on KO‘s conservative guidance for 2026.

Mixed Results Spark Valuation Concerns

The beverage giant’s fourth-quarter earnings sent mixed signals, leading to the rapid erosion of its value ranking.

While the company reported a bottom-line beat with adjusted earnings per share of $0.58, it missed revenue expectations for the first time in five years, recording $11.80 billion against a $12.02 billion forecast.

This revenue shortfall, coupled with the stock’s recent double-digit gains, pushed KO into the bottom 10% of stocks for relative worth.

Defensive Haven Vs. Overvalued Asset

While Coca-Cola remains a staple of defensive ETFs like Consumer Staples Select Sector SPDR Fund (NYSE:XLP) and Vanguard Consumer Staples ETF (NYSE:VDC) due to its dividend reliability and brand power, the new Benzinga rankings highlight an emerging risk.

Per the ranking descriptions, a value score of 3.28 indicates that the stock’s market price is now significantly disconnected from its underlying operating performance.

As leadership transitions to Henrique Braun on March 31, the company faces the challenge of proving its fizz can return without further valuation corrections.

KO Outperforms In 2026

Shares of KO have advanced by 15% year-to-date, while the S&P 500 index was up just 0.33% in the same period.

The stock was 13.35% higher over the last six months and 13.44% over the year. On Thursday, the stock was 0.24% lower in premarket.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments