Opendoor Technologies Inc (NASDAQ:OPEN) shares are trading higher Wednesday morning after a new regulatory filing from homebuilder Lennar Corp Class A (NYSE:LEN) highlighted the depth of its investment in online home-selling platform Opendoor.

The Form 13F shows Lennar holding about 18.8 million shares plus several series of tradable warrants, highlighting a large bet on the stock. Here’s what investors need to know.

- Opendoor Technologies stock is showing exceptional strength. What’s driving OPEN stock higher?

Homebuilder Partnership Fuels Investor Optimism

Lennar is one of the largest U.S. homebuilders, selling single-family homes across many markets and providing in-house mortgage, title and insurance services. Investors see the company as a proxy for housing demand.

Its decision to hold a sizable equity and warrant stake in Opendoor potentially signals confidence that digital, instant-offer home sales will remain important for moving new inventory and that the strategic relationship between the two companies is intact.

Because this support comes from a major industry player, traders interpret the filing as reducing the risk that Lennar might exit the position, a read-through that naturally boosts Opendoor’s share price.

Earnings Ahead Thursday

Opendoor reports earnings Thursday after the bell, with Wall Street looking for a loss of about 10 cents per share on quarterly revenue near $595 million. Any signs of narrowing losses or stronger builder-channel growth could extend the rally.

Mixed Technical Momentum Signals

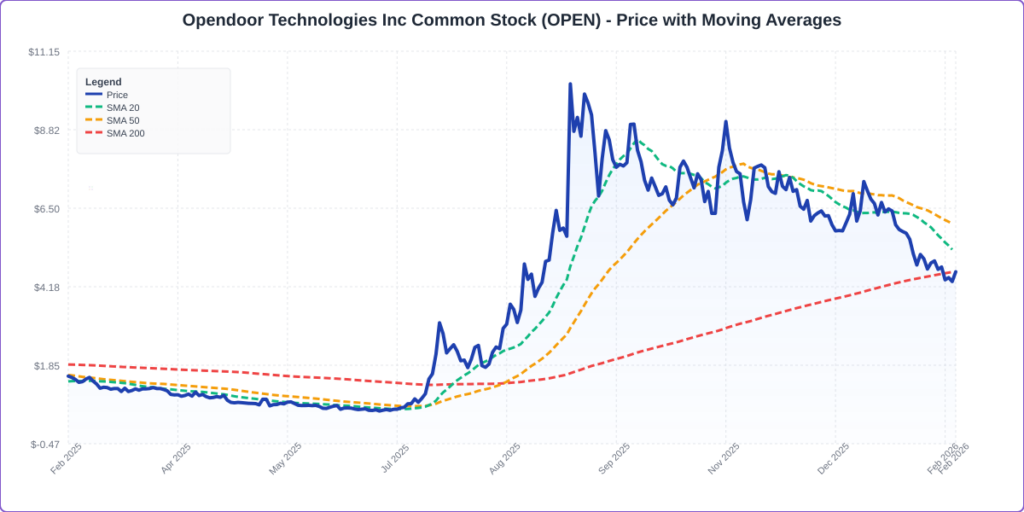

The stock is trading 12.4% below its 20-day SMA of $5.28 and 31.8% below its 100-day SMA of $6.78, indicating some short-term weakness. However, it is currently 0.2% above its 200-day SMA, which may suggest a longer-term bullish outlook.

Over the past 12 months, shares have increased by 202.49%, and they are currently positioned closer to their 52-week highs than lows, reflecting a strong recovery.

The RSI is at 31.41, indicating neutral momentum, while the MACD shows a value of -0.5126, below its signal line of -0.4504, suggesting bearish pressure on the stock.

The combination of neutral RSI and bearish MACD indicates mixed momentum, reflecting uncertainty in the stock’s near-term direction.

- Key Resistance: $5.00

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Opendoor Technologies, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Strong (Score: 96.54) — Stock is outperforming the broader market.

The Verdict: Opendoor Technologies’s Benzinga Edge signal reveals a classic ‘High-Flyer’ setup. While the Momentum (96.54) confirms the strong trend, the company must address its profitability challenges to maintain investor confidence.

OPEN Shares Surge Wednesday

OPEN Price Action: Opendoor Technologies shares were up 5.54% at $4.57 at the time of publication on Wednesday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments