Booking Holdings Inc. (NASDAQ:BKNG) will release earnings results for its fourth quarter, after the closing bell on Wednesday, Feb. 18.

Analysts expect the Norwalk, Connecticut-based company to report quarterly earnings at $48.67 per share, up from $41.55 per share in the year-ago period. The consensus estimate for Booking’s quarterly revenue is $6.13 billion, versus $5.47 billion a year earlier, according to data from Benzinga Pro.

On Feb. 3, Booking Holdings named Peer Bueller as CEO of KAYAK.

Booking Holdings shares slipped 0.01% to close at $4,140.15 on Tuesday.

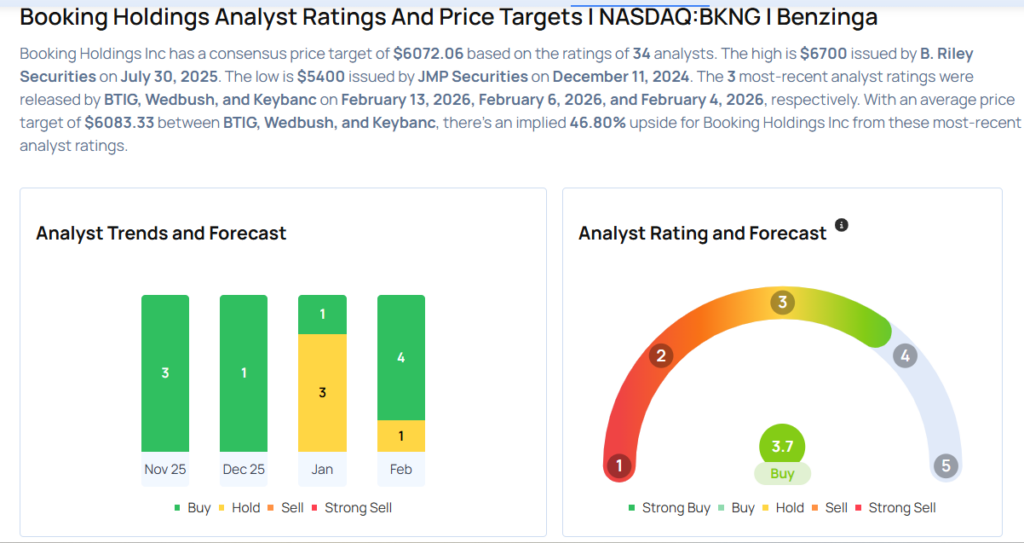

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Wedbush analyst Scott Devitt maintained Booking Holdings with an Outperform rating and lowered the price target from $6,000 to $5,500 on Feb. 6, 2026. This analyst has an accuracy rate of 79%.

- Keybanc analyst Justin Patterson maintained the stock with an Overweight rating and cut the price target from $6,630 to $6,500 on Feb. 4, 2026. This analyst has an accuracy rate of 62%.

- UBS analyst Stephen Ju maintained the stock with a Buy and lowered the price target from $6,806 to $6,608 on Feb. 3, 2026. This analyst has an accuracy rate of 73%.

- Wells Fargo analyst Ken Gawrelski maintained the stock with an Equal-Weight rating and raised the price target from $5,523 to $5,954 on Jan. 9, 2026. This analyst has an accuracy rate of 64%.

- Cantor Fitzgerald analyst Deepak Mathivanan maintained the stock with a Neutral and boosted the price target from $5,550 to $5,830 on Jan. 8, 2026. This analyst has an accuracy rate of 72%.

Considering buying BKNG stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments