Wendy’s Co (NASDAQ:WEN) fell to its lowest level in six years on Tuesday, setting a new 52-week low as investors reacted to weak guidance and mounting Wall Street skepticism. Here’s what investors need to know.

- Wendy’s stock is testing key support levels. Why did WEN hit a new low?

Earnings Top Estimates, Sales Lag

Wendy’s beat expectations for the quarter, posting adjusted earnings of 16 cents per share on revenue of $543 million, modestly ahead of analyst estimates.

However, U.S. same-restaurant sales dropped 11.3% and company-operated margins shrank to 12.7% from 16.5%, pressured by softer traffic and higher food and labor costs.

Weak 2026 Guidance, Sagging Traffic Worry Wendy’s Investors

Management’s 2026 outlook undercut consensus, with adjusted EPS projected between 56 and 60 cents versus Wall Street expectations of 86 cents, and global systemwide sales seen roughly flat.

The conservative forecast has amplified concerns that Wendy’s turnaround plan, Project Fresh, may take longer to restore growth in its core U.S. market.

Analysts Slash Targets As Short Interest Remains Elevated

Following the earnings release, BMO Capital cut its price target from $11 to $9, while Evercore ISI reduced its target from $9 to $8, both maintaining neutral ratings.

Short interest has meanwhile climbed to more than half of Wendy’s freely traded shares, signaling that bearish bets remain crowded even at today’s multi-year lows.

Technical Indicators Signal Bearish Bias

The stock is currently trading 7.3% below its 20-day simple moving average (SMA) and 15.5% below its 100-day SMA, indicating significant bearish momentum. Over the past 12 months, shares have decreased by 53.57% and are positioned closer to their 52-week lows than highs.

The RSI is at a neutral level, indicating that the stock is neither overbought nor oversold. Meanwhile, MACD is below its signal line, suggesting bearish pressure on the stock.

The combination of neutral RSI and bearish MACD indicates mixed momentum.

- Key Resistance: $7.50

- Key Support: $6.50

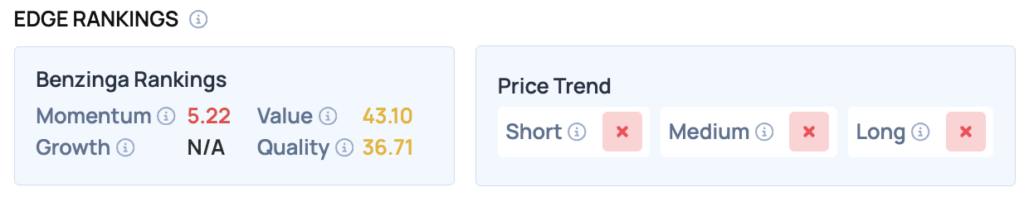

Benzinga Edge Rankings

Benzinga Edge currently assigns Wendy’s shares a low 5.22 momentum score, underscoring the stock’s weak performance profile.

Shares Fall 7% Tuesday

WEN Price Action: Wendy’s shares were down 7.02% at $6.95 at the time of publication on Tuesday. The stock is trading at a new 52-week low, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments