The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here’s the latest list of major oversold players in this sector, having an RSI near or below 30.

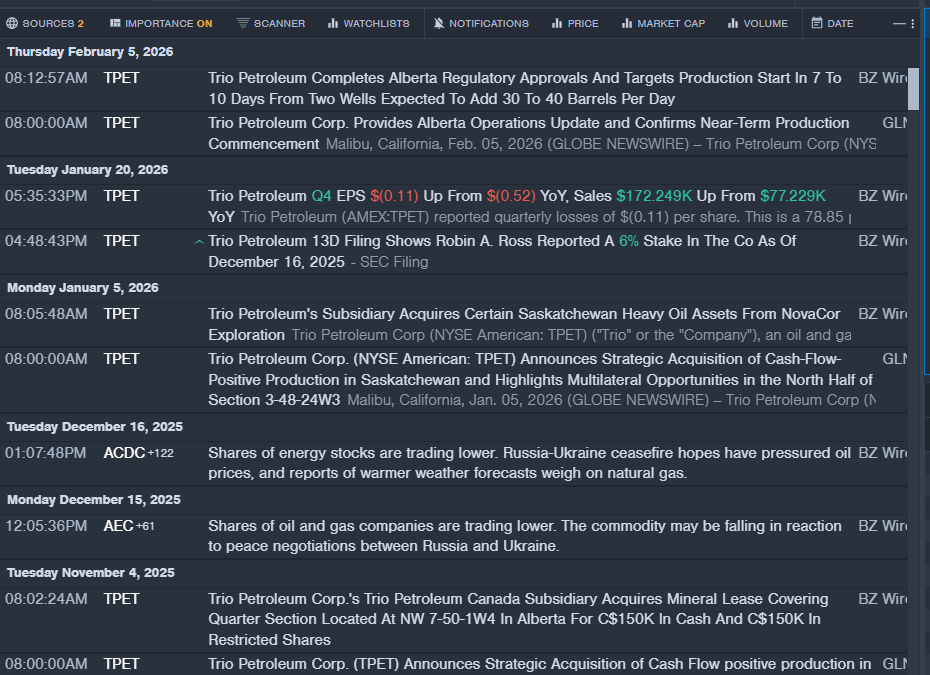

Trio Petroleum Corp (NYSE:TPET)

- On Jan. 20, Trio Petroleum posted a fourth-quarter loss of 11 cents per share, versus a year-ago loss of 52 cents per share. The company’s stock fell around 52% over the past month and has a 52-week low of $0.40.

- RSI Value: 23.2

- TPET Price Action: Shares of Trio Petroleum fell 3.1% to close at $0.41 on Friday.

- Benzinga Pro’s newsfeed tool helped identify latest developments in TPET stock.

Rubico Inc (NASDAQ:RUBI)

- On Feb. 10, Rubico announced a 1-for-7 reverse stock split. The company’s stock fell around 47% over the past five days and has a 52-week low of $2.40.

- RSI Value: 21.3

- RUBI Price Action: Shares of Rubico fell 6.1% to close at $2.46 on Friday.

- Benzinga Pro’s charting tool helped identify the trend in RUBI stock.

Verde Clean Fuels Inc (NASDAQ:VGAS)

- On Feb. 6, Verde Clean Fuels suspended development of its Permian Basin project due to changing market conditions. “We are thankful to Diamondback for their support of the Permian Basin project. The learnings from the work that was completed, in particular from the FEED study, will continue to be useful as we explore other opportunities to deploy our technology. This allows us to devote our resources toward other opportunities we have been developing in regions where natural gas is stranded or flared without access to a higher value outlet to market. Cottonmouth remains our second largest shareholder and supportive of our continued efforts to deploy our technology,” said Ernest Miller, CEO of Verde. The company’s stock fell around 62% over the past month and has a 52-week low of $0.92.

- RSI Value: 16.3

- VGAS Price Action: Shares of Verde Clean Fuels fell 4.7% to close at $0.95 on Friday.

- Benzinga Pro’s details feature helped investors understand financials of VGAS stock.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Photo via Shutterstock

Recent Comments