Tesla Inc (NASDAQ:TSLA) shares are trading lower Tuesday afternoon as investors digest fresh labor and regulatory headlines from Europe and the United States. Here’s what investors need to know.

- Tesla stock is trending lower. What’s driving TSLA stock lower?

German Union Escalates Legal Fight With Tesla

In Germany, metalworkers’ union IG Metall filed a criminal defamation complaint against the manager of Tesla’s factory outside Berlin, accusing him of spreading false claims tied to an alleged secret recording of a works-council meeting, according to Reuters.

The union is also seeking a court injunction to halt further remarks and is preparing a separate case over what it calls obstruction of union work at Tesla’s flagship European plant, Reuters reported.

Robotaxi Crash Record Raises Safety Questions

In the U.S., new federal incident filings, as compiled by EV outlet Electrek, show five additional crashes involving Tesla’s supervised “Robotaxi” fleet in Austin in January 2026, lifting the total to 14 since mid-2025.

According to Electrek’s analysis of Tesla’s own mileage disclosures, that works out to roughly one crash every 57,000 miles, several times worse than the accident frequency Tesla itself cites for human drivers.

Prominent Investor Slams Tesla Brand Strategy

Adding to the negative tone, investor Ross Gerber said Tesla’s brand has turned “negative” as CEO Elon Musk shifts focus from mass-market EVs toward autonomy and robotics.

He argued the company might sell more vehicles if it rebranded or even sold its EV business to rival Rivian Automotive Inc (NASDAQ:RIVN), underscoring mounting concern over strategy and perception.

Why This News Matters For TSLA

Together, labor unrest in Germany, a worsening Robotaxi safety record and public criticism of the brand amplify questions about execution risk, regulatory exposure and long-term demand. Those pressures can erode confidence in Tesla’s ability to justify a premium valuation, helping explain why TSLA is under selling pressure Tuesday.

Tesla Faces Technical Headwinds

Tesla is currently trading 4.3% below its 20-day simple moving average (SMA) and 6.1% below its 100-day SMA, indicating short-term weakness while the longer-term trend remains intact.

Shares have increased 14.49% over the past 12 months and are currently positioned closer to their 52-week highs than lows, suggesting some resilience despite today’s decline.

The RSI is at a neutral level, indicating that the stock is neither overbought nor oversold. Meanwhile, MACD is below its signal line, suggesting bearish pressure on the stock.

The combination of neutral RSI and bearish MACD indicates mixed momentum, reflecting uncertainty in the stock’s near-term direction.

- Key Resistance: $452.50

- Key Support: $387.50

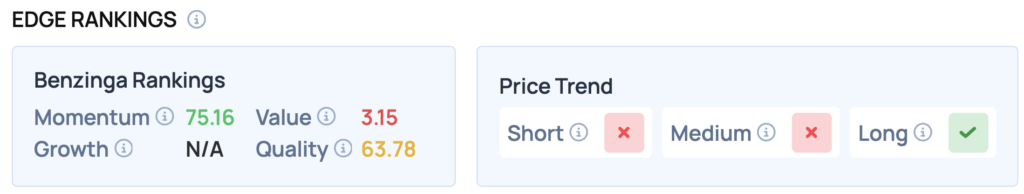

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Tesla, highlighting its strengths and weaknesses compared to the broader market:

- Value: 3.15 — Trading at a steep premium relative to peers.

- Quality: 63.78 — Balance sheet remains healthy.

- Momentum: 75.16 — Stock is outperforming the broader market.

The Verdict: Tesla’s Benzinga Edge signal reveals a classic ‘High-Flyer’ setup. While the Momentum (75.16) confirms the strong trend, the Value (3.15) score warns that the stock is priced for perfection—investors should ride the trend but use tight stop-losses.

TSLA Price Action: Tesla shares were down 3% at $404.90 at the time of publication on Tuesday, according to Benzinga Pro.

Image: courtesy of Tesla

Recent Comments