Harvard University has cut back on its Bitcoin (CRYPTO: BTC) position and dived into Ethereum (CRYPTO: ETH) for the first time, according to its latest 13F filing released on Friday.

Harvard Loses Significant Chunk Of Bitcoin ETF

Harvard Management Company, a wholly owned subsidiary of Harvard University that manages its financial assets, reported holding 5.35 million shares of iShares Bitcoin Trust ETF (NASDAQ:IBIT) as of Dec. 31, down 21% from the previous quarter.

The stake was worth $265.80 million based on IBIT’s price of 49.65 on Dec. 31.

Despite the reduced exposure, IBIT holdings remained Harvard’s largest position, making up 12.78% of the total portfolio.

New Ethereum ETF Position

On the other hand, Harvard bought into the iShares Ethereum Trust ETF (NASDAQ:ETHA) for the first time, scooping up 3,870,900 shares, worth $86.82 million, based on ETHA’s price of $22.43 on Dec. 31.

Interestingly, both ETFs faced pressures last year, compounded by the broader cryptocurrency market slump.

| ETF | 2025 Gains +/- | Price (Recorded at 9:30 p.m. ET) |

|---|---|---|

| iShares Bitcoin Trust ETF | -11.20% | $68,886.53 |

| iShares Ethereum Trust ETF |

-17.90% | $15.44 |

What Next?

The rotation from Bitcoin to Ethereum prompted Binance (CRYPTO: BNB) founder Changpeng Zhao to speculate whether the Ivy League institution would shift toward altcoins next.

Price Action: At the time of writing, BTC was exchanging hands at $68,873, up 1% in the last 24 hours, according to data from Benzinga Pro. ETH traded

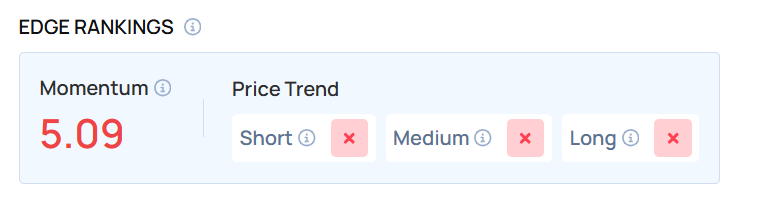

Benzinga’s Edge Stock Rankings show IBIT ETF lagging in price trends across short, medium, and long terms, with a weak Momentum score.

Photo Courtesy: f11photo on Shutterstock.com

Recent Comments