QuantumScape Corporation (NYSE:QS) shares are up on Friday after the company this week reported a fourth-quarter loss that beat analyst expectations. However, the stock remains down roughly 16% over the past five trading days.

Here’s what investors need to know.

- QuantumScape stock is gaining positive traction. Why is QS stock advancing?

QuantumScape Narrows Quarterly Loss

QuantumScape this week reported a fourth-quarter loss of 17 cents per share, which was better than the expected loss of 18 cents per share. The company also noted that capital expenditures totaled $36.3 million for the full year, with customer billings reaching $19.5 million in 2025.

In a letter to shareholders, QuantumScape emphasized its diverse customer base and robust partner ecosystem, stating, “We believe we have a diverse group of customer and application opportunities, a robust and growing partner ecosystem, and a differentiated technology platform.”

The company plans to focus on demonstrating scalable production of its solid-state battery technology in 2026.

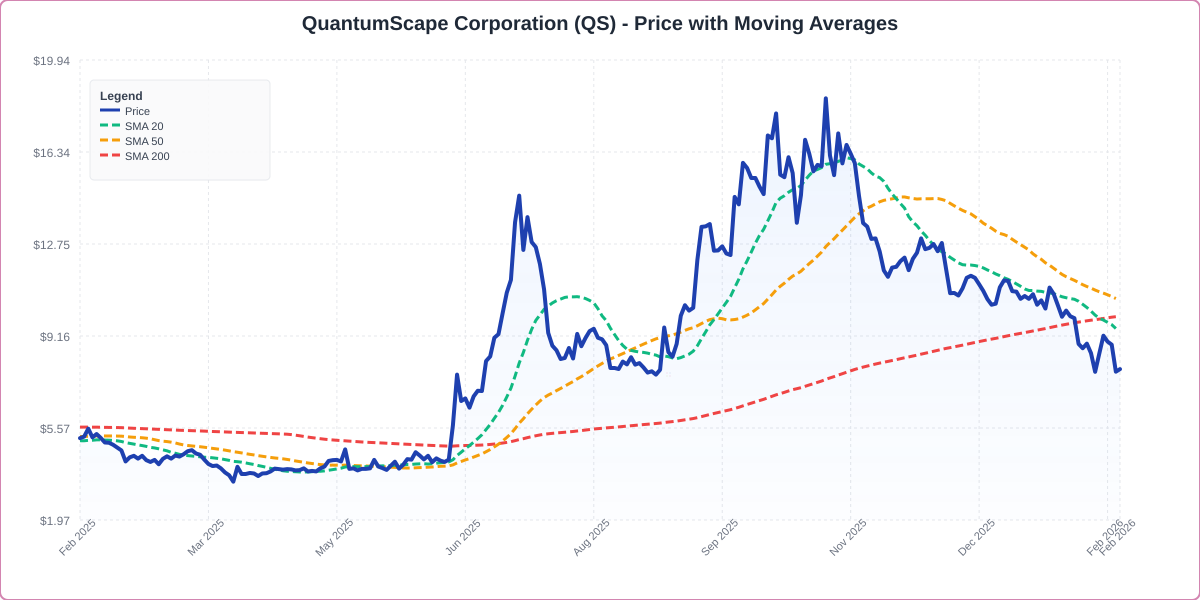

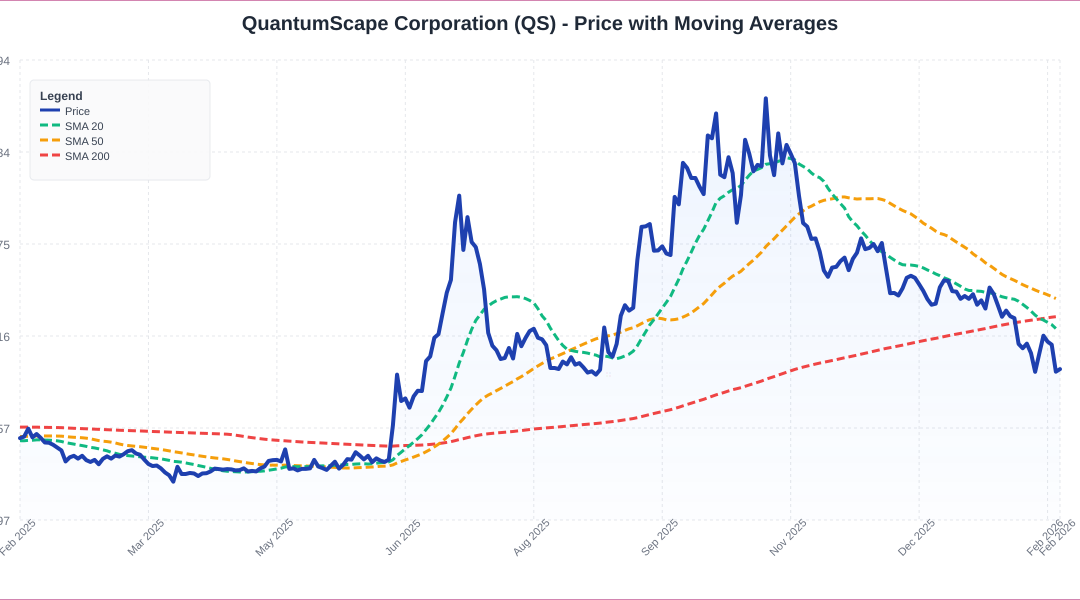

Shares Below Key Averages

Technical indicators reveal that QuantumScape is currently trading 16.4% below its 20-day simple moving average (SMA) and 37.2% below its 100-day SMA, highlighting a challenging short-term outlook.

However, shares have increased 53.29% over the past 12 months, indicating a strong longer-term performance despite current pressures.

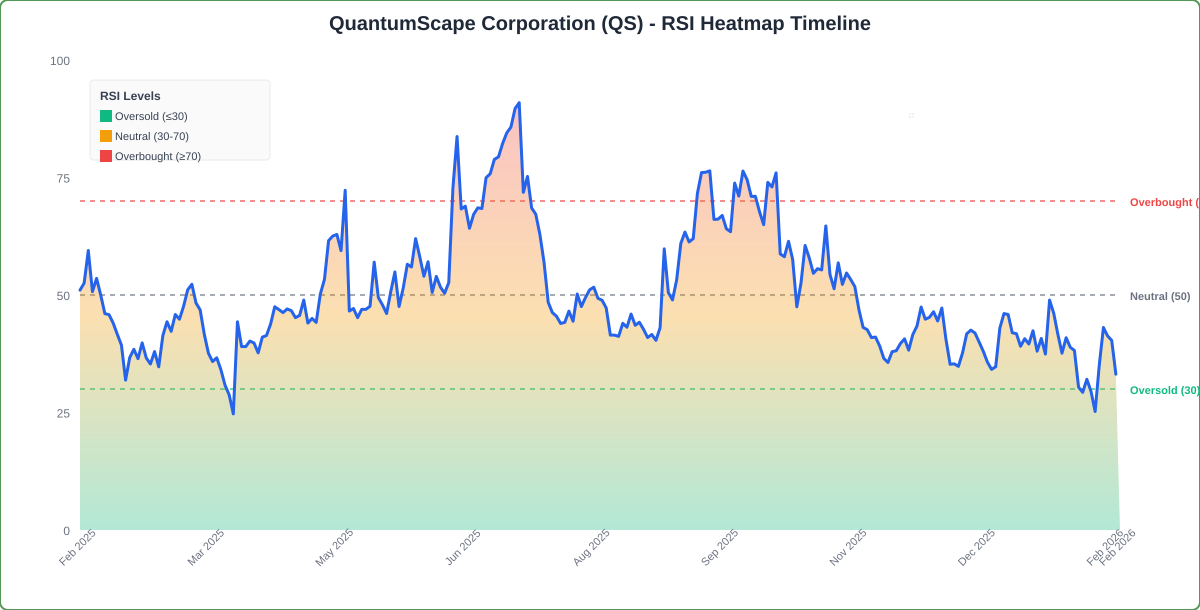

The RSI is at 33.23, which is considered neutral territory, while the MACD is below its signal line, indicating bearish pressure on the stock.

The combination of neutral RSI and bearish MACD suggests mixed momentum, reflecting uncertainty among traders.

- Key Resistance: $9.50

- Key Support: $7.50

QuantumScape’s Solid-State Battery Business Model

QuantumScape is engaged in the development of next-generation solid-state lithium-metal batteries for use in electric vehicles and other applications.

The company’s solid-state lithium-metal battery technology is designed to offer greater energy density, faster charging and enhanced safety. Its battery cells have none of the host materials used in conventional anodes.

This innovative approach positions QuantumScape as a significant player in the energy storage market, especially as the demand for electric vehicles continues to rise.

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for QuantumScape, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Strong (Score: 71.79) — Stock is outperforming the broader market.

The Verdict: QuantumScape’s Benzinga Edge signal reveals a strong momentum score, indicating positive price action relative to the market. Investors should monitor the stock closely as it navigates its technical challenges and prepares for its upcoming earnings report.

QS Shares Edge Higher Friday

QS Price Action: QuantumScape shares were up 2.32% at $7.95 at the time of publication on Friday, according to Benzinga Pro data.

Recent Comments