Lincoln Electric Holdings (NASDAQ:LECO) reported mixed results for the fourth quarter on Thursday.

The company posted quarterly earnings of $2.65 per share which beat the analyst consensus estimate of $2.54 per share. The company reported quarterly sales of $1.079 billion which missed the analyst consensus estimate of $1.099 billion.

“We finished the year with strong results and record sales, adjusted EPS and cash returns to shareholders in 2025,” said Steven B. Hedlund, Chairman and Chief Executive Officer. “We are effectively navigating a dynamic operating environment by capitalizing on growth opportunities, mitigating costs, and reshaping the business to extend our leadership position,” Hedlund commented. “We are looking ahead to driving growth, higher profitability and returns as we execute on our new RISE strategy and achieve our 2030 targets.”

Lincoln Electric shares gained 0.3% to trade at $296.95 on Friday.

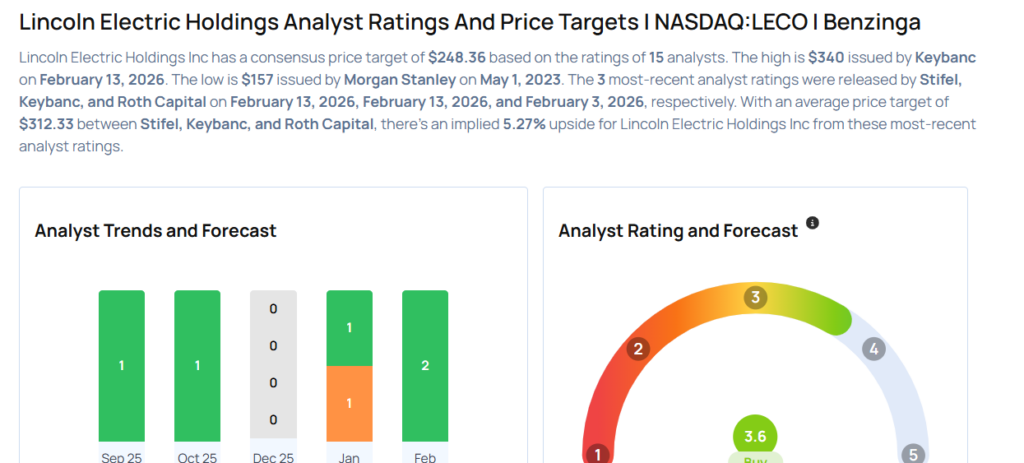

These analysts made changes to their price targets on Lincoln Electric following earnings announcement.

- Keybanc analyst Steve Barger maintained Lincoln Electric with an Overweight rating and raised the price target from $280 to $340.

- Stifel analyst Nathan Jones maintained the stock with a Hold and raised the price target from $253 to $300.

Considering buying LECO stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments