Eli Lilly and Company (NYSE:LLY) has stockpiled $1.5 billion worth of inventory of its experimental oral weight-loss drug, orforglipron, according to a regulatory filing on Thursday.

This significant inventory buildup is in anticipation of a decision by the U.S. Food and Drug Administration (FDA) expected in April. The inventory value has seen a substantial increase from last year’s nearly $550 million.

The FDA has awarded the weight-loss pill a fast-track review voucher, potentially shortening the approval timeline to one or two months, a sharp reduction from the usual 10 to 12 months required for most new drugs.

Eli Lilly has previously said it expects to have sufficient supply to roll out its highly anticipated weight-loss pill across multiple countries at nearly the same time, pending U.S. approval.

Medicare Boost For Obesity Drugs

Eli Lilly and Company CEO Dave Ricks struck an upbeat tone on the outlook for obesity treatments, pointing to Medicare’s planned coverage expansion as a potential game changer. He said the move could dramatically broaden access to the company’s experimental weight-loss pill, orforglipron, helping make GLP-1 therapies more affordable and widely adopted.

In September, the company said that a late-stage clinical trial showed oral orforglipron significantly reduced body weight and waist size versus placebo over 72 weeks in adults with obesity or overweight without diabetes. The drug also achieved meaningful reductions of 10% or more in body weight and lowered waist circumference.

Meanwhile, the weight-loss market is heating up with competition, as Novo Nordisk A/S (NYSE:NVO) plans to start selling its blockbuster obesity drug Wegovy in vials, intensifying its position against rival Eli Lilly’s Zepbound.

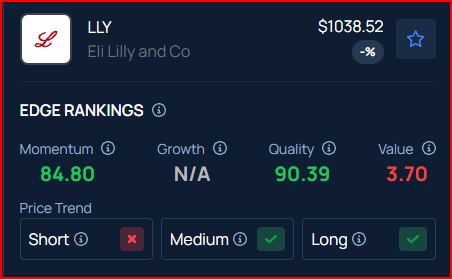

Benzinga’s Edge Rankings place LLY in the 90th percentile for quality and the 84th percentile for momentum, reflecting its strong performance in both areas. Benzinga’s screener allows you to compare LLY’s performance with its peers.

Price Action: Over the past year, Eli Lilly stock climbed 19.09%, as per data from Benzinga Pro. On Thursday, the stock rose 2.27% to close at $1,038.27.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock

Recent Comments