U.S. stock futures rose on Thursday following Wednesday’s decline. Futures of major benchmark indices were higher after the strong January jobs report.

The January employment report revealed that the U.S. economy added 130,000 jobs in January, surpassing economists’ expectations of 70,000 jobs. This was also a huge improvement over December, when 48,000 jobs were added. However, the jobs report also included sweeping benchmark revisions that erased roughly 898,000 jobs from payroll estimates from April 2024 through March 2025.

On Wednesday, the Dow Jones index declined, slipping after a record-high close on Tuesday.

Meanwhile, the 10-year Treasury bond yield stood at 4.175%, and the two-year bond yield was 3.502%. The CME Group’s FedWatch tool‘s projections show markets pricing a 94.1% likelihood of the Federal Reserve leaving the current interest rates unchanged in March.

| Index | Performance (+/-) |

| Dow Jones | 0.21% |

| S&P 500 | 0.23% |

| Nasdaq 100 | 0.17% |

| Russell 2000 | 0.39% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 and Nasdaq 100, respectively, were higher in premarket on Thursday. The SPY was up 0.35% at $694.34, while the QQQ declined 0.27% to $614.76.

Stocks In Focus

Micron

Micron Technology Inc. (NASDAQ:MU) jumped 3.33% in pre-market trading, continuing to gain following a surge of nearly 10% on Wednesday after Morgan Stanley raised its price target to $450, implying an upside of around 10% from the stock’s closing price on Wednesday.

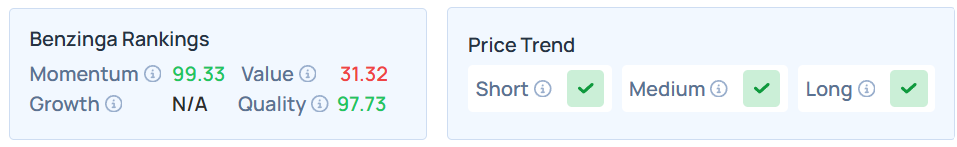

MU maintains a strong price trend over the short, medium, and long terms, as per Benzinga’s Edge Stock Rankings.

Novocure

Novocure Ltd. (NASDAQ:NVCR) shares soared nearly 33% in Thursday’s pre-market after the U.S. Food and Drug Administration (FDA) approved Optune Pax for the treatment of adult patients with locally advanced pancreatic cancer.

NVCR maintains a strong price trend over the short and medium, but a weaker trend over the long term, as per Benzinga’s Edge Stock Rankings.

Fastly

Fastly Inc. (NASDAQ:FSLY) shares were up nearly 43% in Thursday’s pre-market session after the company’s fourth-quarter (Q4) results beat expectations. Fastly reported earnings per share (EPS) of $0.12 on revenue of $172.61 million, beating expectations of an EPS of -$0.03 on revenue of $161.38 million.

FSLY maintains a strong price trend over the short, medium, and long terms, as per Benzinga’s Edge Stock Rankings.

McDonald’s

McDonald’s Corp. (NYSE:MCD) reported stronger than expected Q4 earnings and sales driven by its value offerings and promotions. McDonald’s CEO Chris Kempczinski stated that the company has improved traffic and its value and affordability scores by listening to customer feedback.

MCD maintains a strong price trend over the short, medium, and long terms, as per Benzinga’s Edge Stock Rankings.

Applovin

Applovin Corp. (NASDAQ:APP) reported better-than-expected Q4 results, with an EPS of $3.24 on revenue of $1.66 billion, while Wall Street estimated an EPS of $2.93 on revenue of $1.61 billion. However, Applovin shares fell more than 4% in Thursday’s pre-market session.

APP maintains a weak price trend over the short, medium, and long terms, as per Benzinga’s Edge Stock Rankings.

Cues From Last Session

| Index | Performance (+/-) | Value |

| Dow Jones | -0.13% | 50,121.40 |

| S&P 500 | -0.0049% | 6,941.47 |

| Nasdaq Composite | -0.16% | 23,066.47 |

| Russell 2000 | -0.38% | 2,669.47 |

Insights From Analysts

Analysts at the Schwab Center for Financial Research noted that investors will be waiting for round two with the Consumer Price Index (CPI) set to be released on Friday.

“The market is aggressively pricing out rate cuts for this year after the jobs report,” said Kevin Gordon, head of macro research and strategy at the Schwab Center for Financial Research.

The chances of a Federal Reserve rate cut next month fell dramatically to just 6% from 20% earlier this week, while chances of at least one rate cut by June now stand at less than 60%, down from 75% on Tuesday, the analyst said.

“The Fed looks vindicated in saying there has been some stabilization in the unemployment rate. The three-month average of nonfarm payroll growth shifted up to 73,000 in January, the highest since February 2025,” he added.

Upcoming Economic Data

Here’s what investors will be keeping an eye on Thursday.

- Initial jobless claims data for the week ending Feb. 7 will be released at 8:30 a.m. ET.

- January’s existing home sales data will be out by 10:00 a.m., and Fed governor Stephen Miran will speak at 7:00 p.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 0.36% to hover around $64.86 per barrel.

Gold Spot US Dollar declined 0.47% to hover around $5,059.50 per ounce. Its last record high stood at $5,595.46 per ounce. The U.S. Dollar Index spot was 0.03% higher at the 96.8610 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.15% higher at $66,906.94 per coin.

Asian markets closed mixed on Wednesday, as China’s CSI 300 surged, while India’s Nifty 50 declined. Australia’s ASX 200, Japan’s Nikkei 225 and South Korea’s Kospi indices rose, while Hong Kong’s Hang Seng declined. European markets were mostly higher in early trade.

Photo courtesy: Shutterstock

Recent Comments