Rocket Lab Corp (NASDAQ:RKLB) shares are trading lower Thursday afternoon, extending a volatile stretch for space-related equities as investors keep rotating out of the group. The pullback comes as the space trade shows renewed weakness and traders reassess financing risk across capital-intensive names.

- Rocket Lab stock is among today’s weakest performers. What’s pressuring RKLB stock?

Space Stocks Extend Weakness

Space stocks ran in 2025, but the sector has hit resistance in 2026 as speculation around a potential SpaceX IPO pulls liquidity toward a “wait-and-see” posture. That repositioning has coincided with broad declines across launch and satellite peers in recent weeks.

Rocket Lab News Adds Company-Specific Pressure

For Rocket Lab, recent volatility has also been tied to a key headline: Congress’ decision to withhold funding for a planned 2031 Mars sample-return mission, an overhang that has pushed investors to recalibrate the company’s longer-term opportunity set.

Meanwhile, Rocket Lab remains in build mode on its reusable Neutron rocket, and sentiment can swing quickly when the market is already de-risking the broader space complex.

Why AST SpaceMobile’s Capital Raise Still Matters For The Group

AST SpaceMobile Inc (NASDAQ:ASTS) late Wednesday announced a major capital raise, pricing $1.0 billion of 2.250% convertible senior notes due 2036 with an initial conversion price of about $116.30 per share (roughly a 20% premium to the prior close) and an option for buyers to purchase up to an additional $150 million of notes. ASTS also disclosed a registered direct offering totaling 6,337,964 shares.

Big financings like this can create an overhang across the space sector: traders worry about dilution if converts turn into shares and about technical pressure from convertible-arbitrage hedging. In a market already treating space names as higher risk, that combination can amplify downside moves in stocks like RKLB.

Rocket Lab Stock’s Volatile Year

Rocket Lab shares traded between a low of $16.37 and a high of $96.30 over the past year, staging a sharp rally into late 2025 before pulling back into early 2026.

The stock remains above its 200-day moving average despite the recent decline, though short-term momentum has weakened as shares slip below the 20-day average.

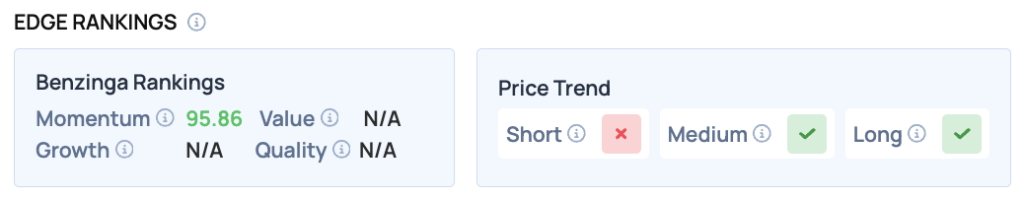

Benzinga Edge Rankings

Benzinga Edge data shows Rocket Lab with a standout Momentum score of 97.98, while its short- and medium-term price trends are marked bearish and the long-term trend remains bullish.

RKLB Shares Slide Thursday

RKLB Price Action: Rocket Lab shares were down 6.08% at $65.39 at the time of publication on Thursday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments