Astera Labs Inc (NASDAQ:ALAB) shares are trading lower Thursday, extending steep losses from Wednesday’s session as investors reassessed the chip designer’s latest results and guidance.

Tech stocks are also lower on Thursday after Cisco Systems issued a cautious margin outlook, reigniting investor concerns about the durability of profits tied to the AI trade.

Here’s what investors need to know.

- Astera Labs shares are retreating from recent levels. Why is ALAB stock dropping?

ALAB Stock Extends Post-Earnings Slide

ALAB stock slid nearly 20% on Wednesday after the company posted fourth-quarter revenue of $270.6 million, above Wall Street’s $249.5 million estimate, and adjusted earnings of 58 cents per share versus 51 cents expected.

Management also projected first-quarter sales of $286 million to $297 million, comfortably ahead of consensus, but the upbeat outlook has not stopped near-term selling.

Profit-Taking, CFO Transition Pressure Shares

Part of the pullback appears tied to profit-taking after Astera Labs surged more than 40% over the past year, leaving valuations elevated versus peers.

The company also announced a leadership change, with longtime finance chief Mike Tate stepping down to become a strategic adviser and Desmond Lynch set to assume the CFO role in early March.

Some investors may see the transition, along with concerns about margins and hardware mix, as a reason to lock in gains despite the earnings beat.

AI Data Center Demand Supports Long-Term Case For Astera Labs

Wall Street is not abandoning the story. JPMorgan reiterated its Overweight rating on Astera Labs while trimming its price target to $205 from $215, citing near-term pressure but strong demand for AI infrastructure.

The firm highlighted adoption of Astera’s Scorpio and Taurus connectivity chips, which help power data-center build-outs at customers including Nvidia, AMD, Amazon and Google.

Analysts expect those products, plus a broader pipeline through 2026, to drive continued revenue growth even as management navigates profitability headwinds.

Astera Labs Signals Bearish Momentum

Astera Labs is currently trading 23.1% below its 20-day simple moving average (SMA) and 25.1% below its 100-day SMA, indicating a bearish trend in the short to medium term.

Shares have increased 46.62% over the past 12 months and are currently positioned closer to their 52-week highs than lows.

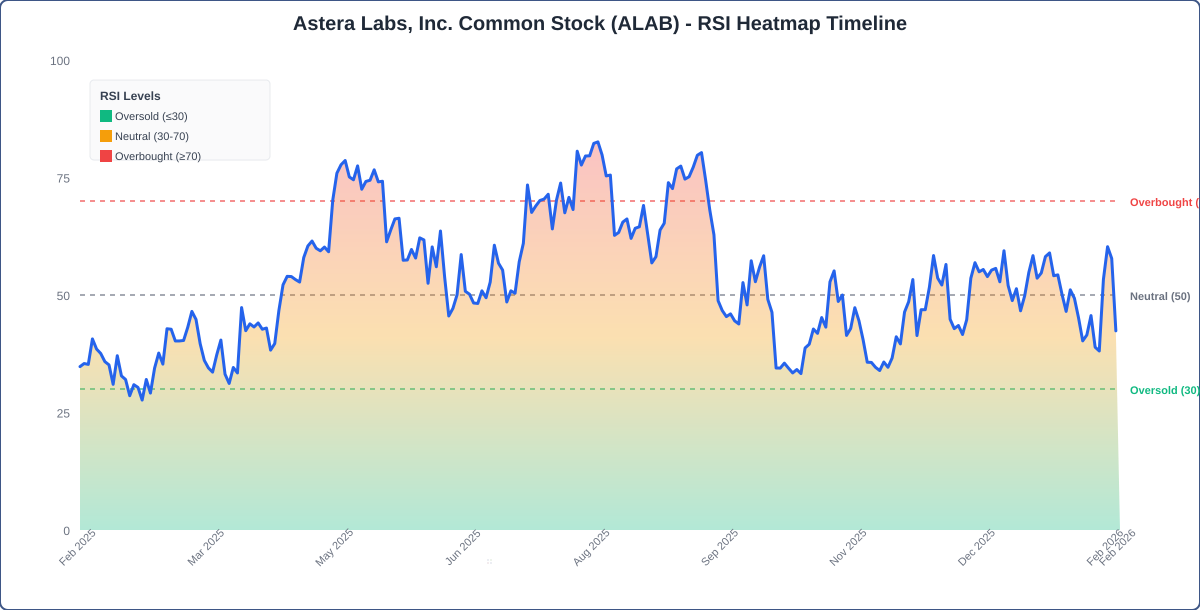

The RSI is at 42.70, which is considered neutral territory, while the MACD is below its signal line, indicating bearish pressure on the stock.

The combination of neutral RSI and bearish MACD suggests mixed momentum.

- Key Resistance: $166.50

ALAB’s Business Model

Astera Labs designs and delivers semiconductor-based connectivity solutions for cloud and AI infrastructure. Its Intelligent Connectivity Platform integrates semiconductor technology, microcontrollers, sensors and software to enhance performance, scalability and data management. The company offers products such as integrated circuits, boards and modules, catering to hyperscalers and system OEMs.

Astera’s focus on AI-driven platforms positions it well in a rapidly evolving market. The company’s recent innovations and strategic partnerships are critical as it seeks to maintain its competitive edge amid growing demand for advanced AI infrastructure.

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Astera Labs, highlighting its strengths and weaknesses compared to the broader market:

- Value: 3.86 — Trading at a premium relative to peers.

- Momentum: 70.97 — Stock is outperforming the broader market.

The Verdict: Astera Labs’ Benzinga Edge signal reveals a strong momentum score, indicating that the stock is currently outperforming the market. However, the low value score suggests that it may be trading at a premium, which could raise concerns for value-focused investors.

ALAB Shares Slide on Thursday

ALAB Price Action: Astera Labs shares were down 11.94% at $126.59 at the time of publication on Thursday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments