Unity Software Inc. (NYSE:U) will release earnings for its fourth quarter before the opening bell on Wednesday, Feb. 11.

Analysts expect the San Francisco, California-based company to report quarterly loss of 21 cents per share, versus a year-ago loss of 30 cents per share. The consensus estimate for Unity Software’s quarterly revenue is $492.82 million (it reported $457.1 million last year), according to Benzinga Pro.

On Feb. 10, Unity appointed gaming and technology veteran Bernard Kim as an independent director to its Board of Directors, effective May 1.

Shares of Unity Software gained 5.6% to close at $29.06 on Tuesday.

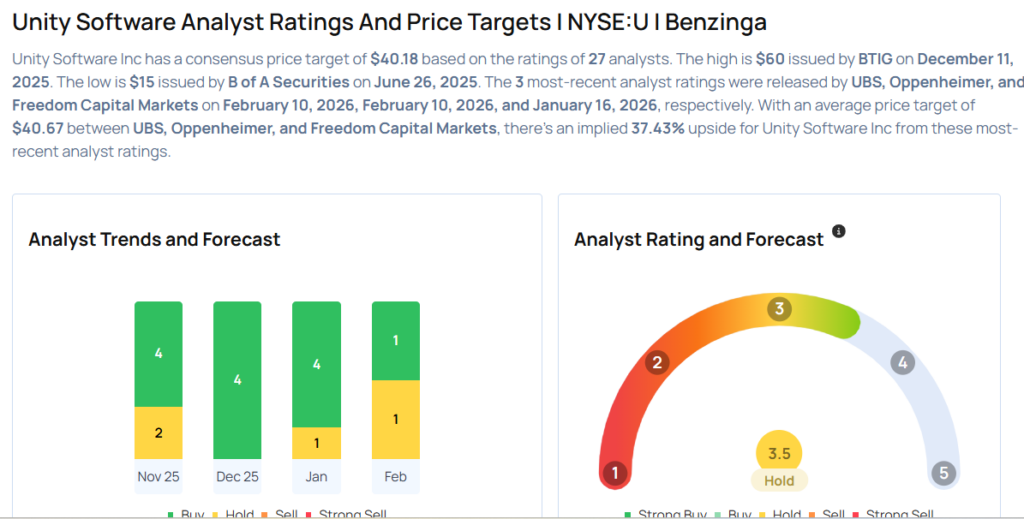

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Oppenheimer analyst Martin Yang upgraded the stock from Perform to Outperform with a price target of $38 on Feb. 10, 2026. This analyst has an accuracy rate of 79%.

- Freedom Capital Markets analyst Nick McKay initiated coverage on the stock with a Buy rating and a price target of $52 on Jan. 16, 2026. This analyst has an accuracy rate of 87%.

- Goldman Sachs analyst Kash Rangan maintained a Neutral rating and increased the price target from $42 to $47 on Jan. 13, 2026. This analyst has an accuracy rate of 64%.

- Morgan Stanley analyst Matthew Cost maintained an Overweight rating and boosted the price target from $48 to $52 on Jan. 13, 2026. This analyst has an accuracy rate of 52%.

- Jefferies analyst Brent Thill maintained a Buy rating and raised the price target from $49 to $55 on Jan. 5, 2026. This analyst has an accuracy rate of 70%

Considering buying U stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments