Blackline Inc (NASDAQ:BL) reported upbeat earnings for the fourth quarter, but issued weak earnings forecast for the first quarter.

The company posted quarterly earnings of 63 cents per share which beat the analyst consensus estimate of 59 cents per share. The company reported quarterly sales of $183.181 million which beat the analyst consensus estimate of $182.976 million.

BlackLine said it expects first-quarter adjusted EPS of 44 cents to 46 cents, versus market estimates of 55 cents. The company sees sales of $180.000 million-$182.000 million vs $181.418 million analyst estimate.

“Our fourth-quarter performance, highlighted by record bookings, provides encouraging validation of the strategic transformation we initiated over two years ago,” said Owen Ryan, CEO of BlackLine. “The intentional steps we have taken to modernize our Go-To-Market engine, scale our Studio360 platform, and launch Verity AI to deliver outcomes for customers are translating into solid results. While we are pleased with this momentum, we remain focused on disciplined execution to drive revenue growth and operating margin expansion in 2026.”

BlackLine shares dipped 5.4% to trade at $41.95 on Wednesday.

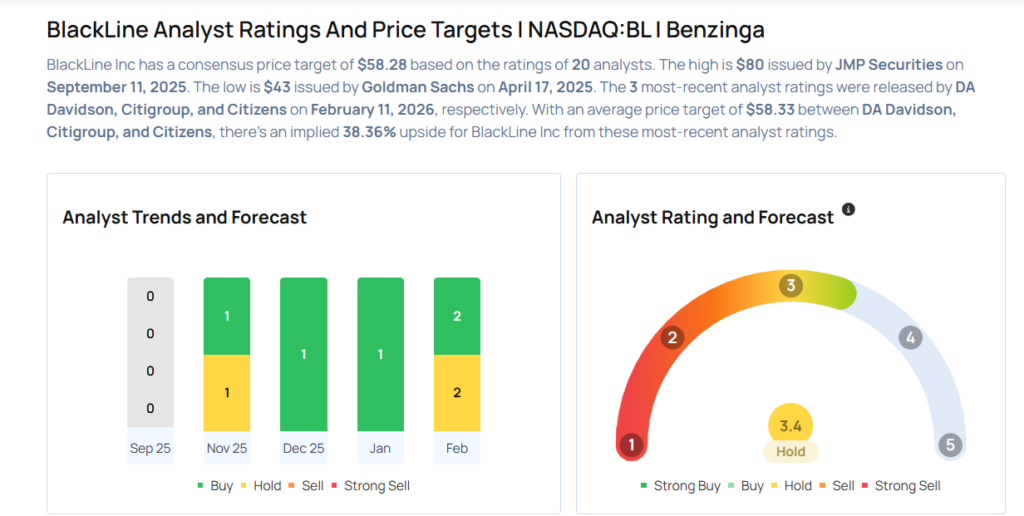

These analysts made changes to their price targets on BlackLine following earnings announcement.

- Cantor Fitzgerald analyst Matthew Vanvliet maintained BlackLine with a Neutral and lowered the price target from $58 to $50.

- Citigroup analyst Steven Enders maintained BlackLine with a Buy and lowered the price target from $70 to $60.

- DA Davidson analyst Lucky Schreiner maintained the stock with a Neutral and lowered the price target from $56 to $45.

Considering buying BL stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments