U.S. stock futures rose on Wednesday following Tuesday’s mixed close. Futures of major benchmark indices were higher.

On Tuesday, the Dow Jones index hit a new record for the third consecutive day, even as the Nasdaq Composite dropped over 100 points.

Investors are bracing for January’s U.S. employment report, unemployment rate, and hourly wages data scheduled to be released today before the market opens.

Meanwhile, the 10-year Treasury bond yielded 4.13%, and the two-year bond was at 3.45%. The CME Group’s FedWatch tool‘s projections show markets pricing a 78.9% likelihood of the Federal Reserve leaving the current interest rates unchanged in March.

| Index | Performance (+/-) |

| Dow Jones | 0.20% |

| S&P 500 | 0.17% |

| Nasdaq 100 | 0.14% |

| Russell 2000 | 0.32% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Wednesday. The SPY was up 0.20% at $693.52, while the QQQ advanced 0.18% to $612.32.

Stocks In Focus

Cloudflare

- Cloudflare Inc. (NYSE:NET) jumped 15.23% in premarket on Wednesday, after reporting better-than-expected fourth-quarter financial results and issuing FY26 sales guidance above estimates. The company said it sees full-year 2026 revenue in the range of $2.79 billion to $2.80 billion versus estimates of $2.74 billion.

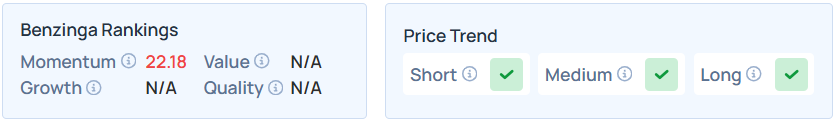

- NET maintains a stronger price trend over the short, medium, and long terms, as per Benzinga’s Edge Stock Rankings.

Mattel

- Mattel Inc. (NASDAQ:MAT) dropped 30.25% after posting downbeat earnings for the fourth quarter. The company reported quarterly earnings of 39 cents per share, which missed the consensus estimate of 54 cents by 27.64%.

- MAT maintains a weaker price trend over the short, medium, and long terms, with a moderate value ranking, as per Benzinga’s Edge Stock Rankings.

AST SpaceMobile

- AST SpaceMobile Inc. (NASDAQ:ASTS) rose 5.43% after it announced the successful unfolding of its next-generation BlueBird 6 satellite, and MSCI Inc. (NYSE:MSCI) said that it had added the satellite communications company to its all-country world index.

- Benzinga’s Edge Stock Rankings indicate that ASTS maintains a stronger price trend over the short, medium, and long terms.

Faraday Future Intelligent Electric

- Faraday Future Intelligent Electric Inc. (NASDAQ:FFAI) advanced 5.40% after it signed upgraded agreements with its Bridge Strategy partner, officially initiating the scaled implementation of its EAI (Engineering, AI) Bridge Strategy.

- Benzinga’s Edge Stock Rankings indicate that FFAI maintains a weaker price trend over the long, medium, and short terms.

Cisco Systems

- Cisco Systems Inc. (NASDAQ:CSCO) rose 0.27% as analysts expect it to post quarterly earnings at $1.02 per share on revenue of $15.11 billion after the closing bell.

- CSCO maintains a stronger price trend over the short, medium, and long terms, with a strong quality ranking, as per Benzinga’s Edge Stock Rankings.

Cues From Last Session

Communication services, financial, and consumer staples stocks led losses on Tuesday as most S&P 500 sectors fell, though utilities and real estate shares rose.

| Index | Performance (+/-) | Value |

| Dow Jones | 0.10% | 50,188.14 |

| S&P 500 | -0.33% | 6,941.81 |

| Nasdaq Composite | -0.59% | 23,102.48 |

| Russell 2000 | -0.34% | 2,679.77 |

Insights From Analysts

Professor Jeremy Siegel maintains a constructive outlook on the U.S. stock market and economy. He characterizes the current environment as a “broadening bull market”, noting that the market’s strength is no longer reliant solely on mega-cap technology names.

Siegel views the shift away from tech as a “rotation” that is “real, it is persistent, and it is healthy”.

Regarding the economy, Siegel is encouraged by solid corporate earnings and a labor market that appears to be “cooling [rather] than contraction.”

While he acknowledges high capital expenditures in the AI sector, he remains a believer in the technology, describing the build-out as a “new industrial revolution.”

Looking ahead, he anticipates “clear sailing in 2026” once near-term political and legal uncertainties—such as an upcoming Supreme Court decision on tariffs—are resolved.

He also supports a gradual return to a “scarce-reserves framework” for monetary policy to better reflect true market supply and demand.

Upcoming Economic Data

Here’s what investors will be keeping an eye on Wednesday.

- January’s U.S. employment report, unemployment rate, and hourly wages data will be out by 8:30 a.m. ET.

- Kansas City Fed President Jeff Schmid will speak at 10:10 a.m., and monthly U.S. federal budget data will be out by 2:00 p.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading higher in the early New York session by 1.49% to hover around $64.91 per barrel.

Gold Spot US Dollar rose 0.57% to hover around $5,052.95 per ounce. Its last record high stood at $5,595.46 per ounce. The U.S. Dollar Index spot was 0.03% higher at the 96.8440 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 3.51% lower at $66,827.67 per coin.

Asian markets closed mixed on Wednesday, as China’s CSI 300 and India’s Nifty 50 indices declined. Australia’s ASX 200, Japan’s Nikkei 225, Hong Kong’s Hang Seng, and South Korea’s Kospi indices rose. European markets were mostly lower in early trade.

Photo courtesy: Shutterstock

Recent Comments