Oracle Corp (NASDAQ:ORCL) shares are trading lower Wednesday morning after initially surging in early trading after the Centers for Medicare & Medicaid Services (CMS) selected Oracle Cloud Infrastructure (OCI) to host key mission-critical systems. Here’s what investors need to know.

- Oracle stock is trading near recent lows. What’s next for ORCL stock?

CMS Chooses Oracle For Medicare, Medicaid Cloud Migration

The federal health agency will shift select on-premises workloads to OCI as part of an IT modernization effort, leaning on Oracle’s FedRAMP High-authorized cloud to meet strict federal security and compliance requirements.

According to the company, OCI is expected to provide CMS with improved performance and scalability, cost efficiencies from consolidating systems and access to integrated analytics and AI tools that can support data-driven decision making and automation initiatives.

Oracle will also supply migration planning and technical support as CMS transitions workloads to the new environment.

ORCL Stock Bounces Around After CMS Cloud Deal

The CMS win adds to Oracle’s growing roster of U.S. federal cloud customers and underscores its push to compete more actively with rivals in government infrastructure deals. Oracle shares initially moved significantly higher following the announcement. Shares have traded within a range of $163.66 to $155.55 on Wednesday.

Technical Indicators Signal Mixed Momentum

Currently, Oracle is trading 5.6% below its 20-day simple moving average (SMA) and 29.2% below its 100-day SMA, demonstrating longer-term weakness. Shares have decreased 9.37% over the past 12 months and are positioned closer to their 52-week lows than highs.

The RSI is at 42.31, which is considered neutral territory. Meanwhile, MACD is below its signal line, indicating bearish pressure on the stock.

The combination of neutral RSI and bearish MACD suggests mixed momentum.

- Key Resistance: $163.50

- Key Support: $154.50

Oracle’s Business Model

Oracle provides enterprise applications and infrastructure offerings through a variety of flexible IT deployment models, including on-premises, cloud-based, and hybrid.

Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system, which is commonly used by the world’s largest companies for high-volume online transaction processing workloads.

The company plays a significant role in the software industry, especially as businesses increasingly rely on cloud solutions and AI technologies.

Analyst Consensus & Recent Actions: The stock carries a Buy Rating with an average price target of $297.36. Recent analyst moves include:

- DA Davidson: Upgraded to Buy (Maintains Target to $180.00) (Feb. 9)

- Citizens: Market Outperform (Lowers Target to $285.00) (Feb. 5)

- Scotiabank: Sector Outperform (Lowers Target to $220.00) (Feb. 3)

Valuation Insight: While the stock trades at a premium P/E multiple, the strong consensus and rising estimates suggest analysts view the growth prospects as justification for the 87% upside to analyst targets.

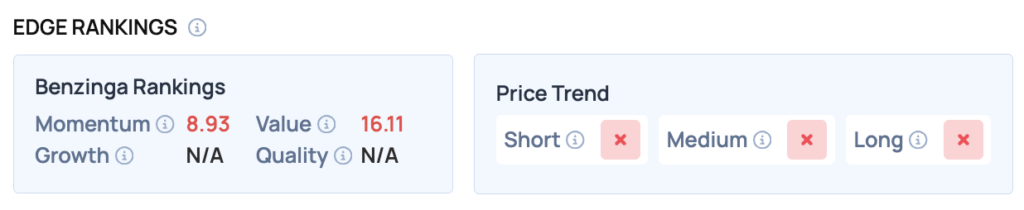

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Oracle, highlighting its strengths and weaknesses compared to the broader market:

- Value: Weak (Score: 16.11) — Trading at a steep premium relative to peers.

- Momentum: Weak (Score: 8.93) — Stock is underperforming the broader market.

The Verdict: Oracle’s Benzinga Edge signal reveals a challenging landscape, with weak momentum and value scores indicating potential headwinds. Investors should be cautious as the stock navigates through a mixed technical environment.

ORCL Shares Trade Flat Wednesday

ORCL Price Action: Oracle shares were down 2.61% at $155.75 at the time of publication on Wednesday, according to Benzinga Pro data.

Image: Shutterstock

Recent Comments