Mattel Inc. (NASDAQ:MAT) agreed to buy NetEase Inc.’s (NASDAQ:NTES) 50% stake in its joint venture Mattel163 for $159 million on Tuesday, as the toymaker doubles down on digital growth and in-house game publishing.

The El Segundo, California-based company said it expects the transaction to close by the end of the first quarter.

The joint venture, formed in 2018, employs several hundred people and has released four mobile titles based on Mattel’s intellectual property, including “Uno” and “Skip-Bo”. Those games have been downloaded 550 million times and currently attract 20 million monthly active users, Mattel said.

Mattel Banks On Digital Growth Amid Competition

“Our vision is to extend physical play to the virtual world by creating digital experiences and games based on Mattel IP that drive sustained engagement for fans of all ages. Acquiring full control of Mattel163 does exactly that,” CEO Ynon Kreiz said in a statement.

Under Kreiz, the “Barbie” and “Hot Wheels” maker has been transforming legacy toy brands like Barbie and Hot Wheels into broader entertainment franchises spanning games, film, television, and theme-park licensing.

The company is ramping up licensing efforts with entertainment firms such as Take-Two, Xbox, Netflix, and Apple Arcade, while also publishing original in-house games and expanding on creator platforms such as Roblox and Fortnite.

Mattel’s move comes as rival Hasbro Inc. (NASDAQ:HAS) rides the success of “Monopoly Go!”, which surpassed $6 billion in in-app purchase revenue last year, according to the company.

However, mobile gaming growth is becoming more expensive. As download growth slows across the industry, publishers are spending heavily to acquire users.

Meanwhile, China-based NetEase has been scaling back international operations, shutting down North American studios and cutting staff as it focuses on key franchises such as Marvel Rivals and Eggy Party.

MAT Stock Craters On Weak Earnings Report

Mattel shares dropped by nearly 31% in trading after the bell on Tuesday, after the company’s full-year profit forecast disappointed investors and fourth-quarter profit came in below estimates. If losses hold, the stock would be set for its worst intraday percentage fall in nearly six years.

The stock had closed down 2.23% at $21.06. So far this year, shares have risen 6% while rival Hasbro has seen a 27% jump, according to data from Benzinga Pro.

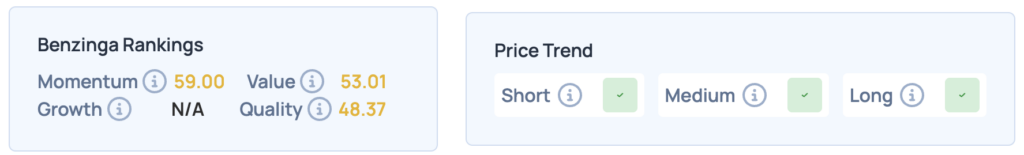

Benzinga’s Edge Rankings indicate balanced but not exceptional fundamentals for MAT, with moderate momentum and value scores, a weaker quality rating, and a consistently positive price trend across short, medium, and long time frames.

Image via Shutterstock

Recent Comments