Monday.com (NASDAQ:MNDY) on Monday posted better-than-expected fourth-quarter earnings but issued weak outlook for 2026.

The company reported a quarterly revenue growth of 25% year-on-year (Y/Y) to $333.88 million, beating the analyst consensus estimate of $329.64 million. The company’s adjusted fourth-quarter EPS of $1.04 beat the analyst consensus estimate of 92 cents.

Co-founders and co-CEOs Roy Mann and Eran Zinman said the company delivered another year of disciplined execution in 2025, posting 27% revenue growth and a 14% adjusted operating margin while expanding its product lineup and driving strong adoption of its AI offerings.

Monday.com expects fiscal first-quarter 2026 revenue guidance of $338.00 million-$340.00 million against the analyst consensus estimate of $342.97 million and an adjusted operating margin outlook of 11%-12%. Monday.com expects 2026 revenue guidance of $1.452 billion-$1.462 billion, against the analyst consensus estimate of $1.477 billion, and an adjusted operating margin outlook of 11%-12%.

Monday.com shares fell 1.3% to $76.60 in pre-market trading.

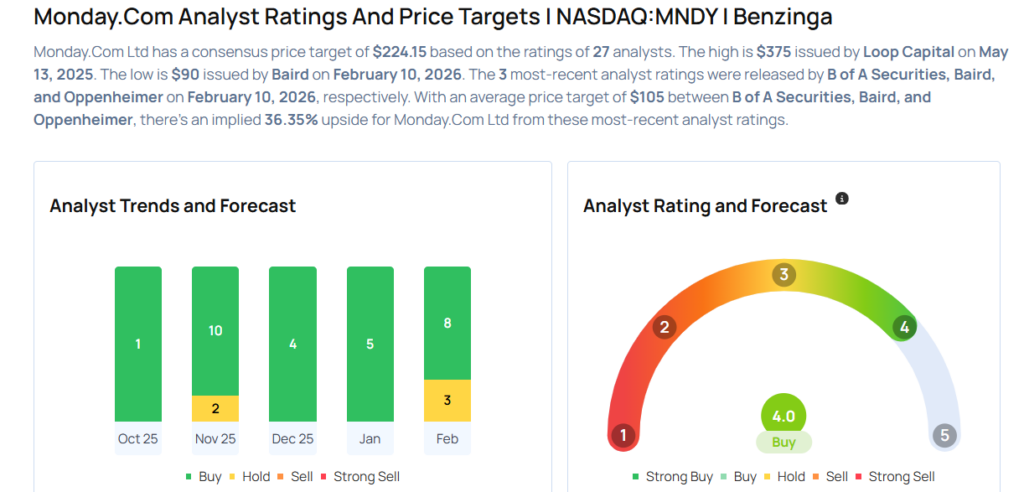

These analysts made changes to their price targets on Monday.com following earnings announcement.

- Piper Sandler analyst Hannah Rudoff maintained Monday.Com with an Overweight rating and lowered the price target from $170 to $100.

- BTIG analyst Allan Verkhovski maintained the stock with a Buy and cut the price target from $210 to $135.

- Oppenheimer analyst George Iwanyc maintained Monday.Com with an Outperform rating and lowered the price target from $200 to $130.

- Baird analyst Rob Oliver downgraded the stock from Outperform to Neutral and lowered the price target from $175 to $90.

- B of A Securities analyst Michael Funk maintained Monday.Com with a Neutral and lowered the price target from $157 to $95.

Considering buying MNDY stock? Here’s what analysts think:

Photo via Shutterstock

Recent Comments